Many of you must be familiar with the name ‘National pension Scheme (NPS) ‘. Last year after budget 2015 it has got much attention through media and corporates alike for the additional tax benefit announced.

We received many queries from our existing clients if it is worth to invest in NPS or not. Many corporates came with circular to this effect to enable to make employees invest in NPS. It is laudable idea to save and invest for the retirement; after all it is one of the primary goals for any individual. Moreover it is essential to build the retirement fund for country like ours where government social benefits are not well structured unlike western countries.

NPS is a defined contribution pension plan with minimal annual contribution of Rs.6,000/- which one needs to contribute till age 60 years. With three options to select from government securities fund, fixed-income instruments other than government securities fund and equity fund but can’t put more than 50% of your money in the equity fund. When you turn 60, you can have up to 60% of this money in a lump sum, and buy an annuity product with the rest. Deferred exit options are available. Early exits are discouraged by mandating 80% of the accumulated corpus to buy an annuity. But the rules now allow for partial withdrawals up to 25% of the contributions for specific purposes.

With this background information about NPS, Let’s see what is the much hyped part of additional Tax benefit announced under new section 80 CCD. One can invest up to Rs. 50,000/- annually to get tax benefit of up to Rs. 15,450 (for those under 30% tax bracket) This benefit is over and above income exemption of Rs.1.5 lakhs under 80C where your EPF, PPF, Insurance policy etc all can be put together.

It is a natural tendency to grab the free benefit- the lure tax saving is one of them. The question is – Is it worthwhile option to lock your funds considering alternative options with more flexibility. We got prompted to write this blog when we see instances of parking more funds to this conservative bend scheme by clients under the name of tax benefit who has got good understanding and appetite for equity. It is no brainer that plain vanilla equity fund will give you more return any day than the funds parked in NPS, as only 50% of contribution goes to equity fund under NPS. Most salaried class compulsorily contribute towards EPF-Employer and employee contribution month on month adds to the big debt portfolio, on top of that by investing in NPS unknowingly you put on more debt.

They say that tax benefit has to be incidental and not the criteria to do the investments. To save tax of odd Rs.15k you definitely forgo the upside of what pure equity investment can give. It is worthwhile to see if you park the similar funds for longer term in equity funds how it will look like compared to NPS.

For the last 20 years some of the best equity Diversified Mutual Fund Category has delivered around 20% odd returns. To assume return for NPS scheme- the debt portion will give 8% and if equity gives 12% return, the weighted average return of NPS can be Farley assumed at 10%.

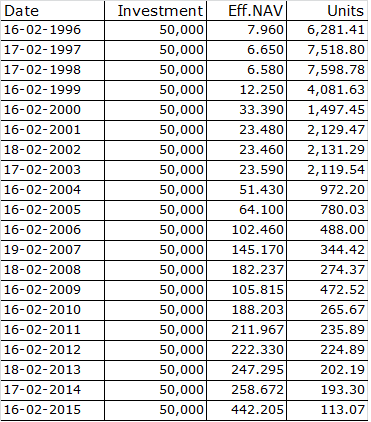

We back tested the data for last 20 years, if you had invested annually Rs. 50,000/- in Franklin India Prima Plus from 1996 to 2015 you would have accumulated Rs. 1.5 crore with CAGR of 22.32%.

If same Rs. 50000/- is invested in NPS at 10% return for next 20 years it will grow to Rs. 28 lakhs odd.

| Rs. 50,000/- invested annually in NPS | 10% | 2,863,750 |

Moreover major disadvantage of NPS is, income is taxable in your hand, that meaning any withdrawal /pension-annuity is taxable in your hand. Funds are locked in for pretty long time with limited liquidity options.

Two plus point of NPS is you can track investments through your online account and choose from the funds. This makes NPS more transparent and flexible compared to the Employees Provident Fund (EPF). Another advantage is fund management charges are minimal for now which may be likely to go up in future.

Conclusion

NPS is better scheme for retirement considering transparency and active management as compared to EPF. Investing in NPS upto the limit of Rs. 50k annually is fine to avail the additional tax benefit. Investing more funds beyond the tax saving limit is not suggested considering low liquidity, compulsory annuity option with added burden of tax on each annuity payment.

It is better to have choice in your hand to use or withdraw pension the way you want it or how much you want it flexibly. On this count other investment options are far better considering flexibility, liquidity and tax free in your hand.

Image Credit-Economic Times