What is the purpose of investing?

To create wealth. To grow your money. To fulfil a specific goal. To feel secure. To build a nest egg. And more. Put simply; there are many reasons to invest.

All things considered, when we invest, we do it with our heads, and hope in our hearts. Above all, we are looking for a better future. Investing is about purpose. It drives the investment journey.

During the investment journey, we, time and again, meet the proverbial Mr Market & Mrs Volatility. It is in their nature to make us anxious. They can push us towards making panicky decisions. To guard against these pitfalls, it is essential to retain a positive outlook, especially when it comes to equity investments. You may read more about this here: Positive thinking alone can improve your investing mindset.

Optimism is only Realism – Nick Murray.

Speaking of, why should you be optimistic while investing in Equity today? Two fundamental reasons and indicators.

The first is GDP – Gross Domestic Product.

GDP is an economic indicator. It is the monetary value of all finished goods and services made within a country during a specific period.

GDP Annual Growth Rate in India averaged 6.13 per cent from 1951 to 2020.

India has emerged as fastest growing emerging economies of the world as per a latest report by International Monetary fund( IMF), it also adds that India is the one country going to have positive GDP growth in 2020 other being China.

The Indian economy expanded by 3.1 per cent year-on-year in the first quarter of 2020 and exceeded market forecasts of 2.1 per cent.

Going forward, despite the pandemic and depending on economic activity over the next 14 months, we expect positive growth. Investors seek growth opportunities. They look to tap consumption stories. These will be key economic drivers in India.

Market contracts less than the Opportunities it offers

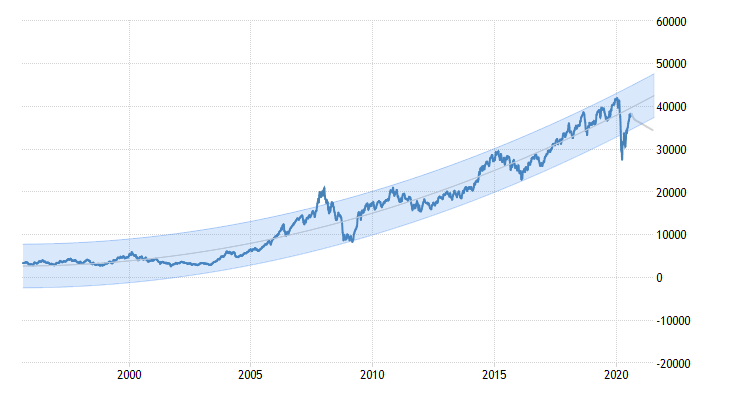

To emphasise this point, we analysed two market indices: Sensex and S&P 500 Index.

The overall trendline shows that the Market dips are lesser than highs. The upward trendline of the Sensex is a good indicator of the fact that the Market delivers more than it loses.

During the 20-year journey of the S&P 500 (US popular benchmark), it has underperformed only 5 years. For 15 years, the Market shows growth.

As demonstrated above, the two most relevant indices contracted less than they expanded. There were many more highs than lows.

The thing to remember is that a temporary fall is only temporary. It’s vital not to let this lead to a panicky reaction and withdraw investments.

Admittedly, a fall can make investors uncomfortable. But remember what Robert Arnott said, “In investing, what is comfortable is rarely profitable.” So.

When investing to meet long term life goals, and achieve happy endings, keep only three things in mind:

- Have a clear vision

- Understand how markets behave in the long term

- Bepatient & stay the course

Finally, I want to close with one of my favourite investment quotes – “Investing should be more like watching paint dry or grass grow. If you want excitement, take $800 and go to Las Vegas.” – Paul Samuelson