“Our favourite holding period is forever.” – Warren Buffett

What is long term? Does Systematic Investing Plan (SIP) work? Should I continue my SIP? Will the markets go down even more? How much more? Should I exit? What should be the new strategy? These are some of the questions that crop up in the minds of investors these days. This case study may provide you with all the answers, and then some.

We have been saying think long term. We have been saying invest systematically. We have been saying don’t respond to short term fluctuations. We have been saying the India growth story is intact. In fact, all the smart advisors have been saying this. And Warren Buffett, the wisest, smartest of all fund managers says, “Our favourite holding period is forever.” This unprecedented guidance is of course based on choosing the places to invest in prudently.

The thing is, not many investors feel comfortable doing something that has proved time and again to be a sound investment strategy. This is because human beings are emotional creatures. We let emotions guide us on many things, too many things. But investments should not be guided by emotions. This real life story proves the soundness of the advantages of keeping emotions in check and staying the course.

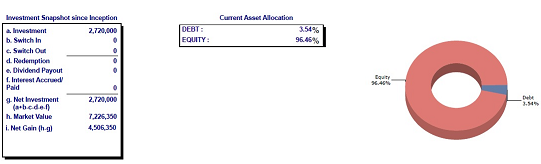

Mr. S (name withheld on request) began investing every month in January 2008. He did this diligently for five years. During this period, he invested a total of 27 lakhs. After 11 years (2008-2019), the market value of his investments is 72 lakhs. This time period includes at least three massive drops in the indices. Despite these drops, Mr. S remained focused. He did not panic. He believed in the long term value of his investment strategy. And he was rewarded handsomely for it with a Compounded Annual Growth Rate of 12%.

What did Mr. S do so well? Nothing. (Please check the image. It tracks his activity chart.)

That’s right. Mr. S did nothing, apart from trust us and the process. Successful investing is based on sound financial knowledge, good advise, implicit trust, long term vision, and, above all, the positive attitude to believe in this vision. Nothing more. More often than not, doing nothing once you have a good strategy in place is the best strategy to garner returns. Mr. S story is real life proof of this.