On 23rd March 2020, after India (and the world) went into lockdown to contain the spread of Covid-19, the financial markets collapsed like a house of cards. As an investor, it is natural to feel fearful and despondent in the face of such adversity.

Between the end of March and May, we had many client interactions that centred around investment portfolios, several of which rapidly contracted by at least 15-25%. Many investors, especially equity, were understably nervous.

Equity investing can, at times, be a stern test of your resolve. This was one such period. As an advisor or an investor, the great challenge in the face of market downturns is to face, understand, endure, and stay resilient.

“Every once in a while, the market does something so stupid it takes your breath away.” – Jim Cramer

With the predicted announcement of economic stimulus packages from many countries and strong policy measures being initiated, we assured clients that the money would return to emerging economies – India, in particular. We expected a rebound and explained why in our March 2020 newsletter. You may read it here. http://eepurl.com/gXeKxP

We closely observed a few portfolio movements from the end of March to now (end of August). Many have bounced back from great lows. In many meetings with clients,we suggested the prudent course of action. We’d like to share one such case with you.

One of our clients, let’s call her Mrs S, holds considerable assets in market-linked investments. She is close to retirement age. She is aware of the economy and the market. We had a brief meeting with her in April, after which we jointly decided to stay put and hold on to the allocation. How did this strategy work out for Mrs S?

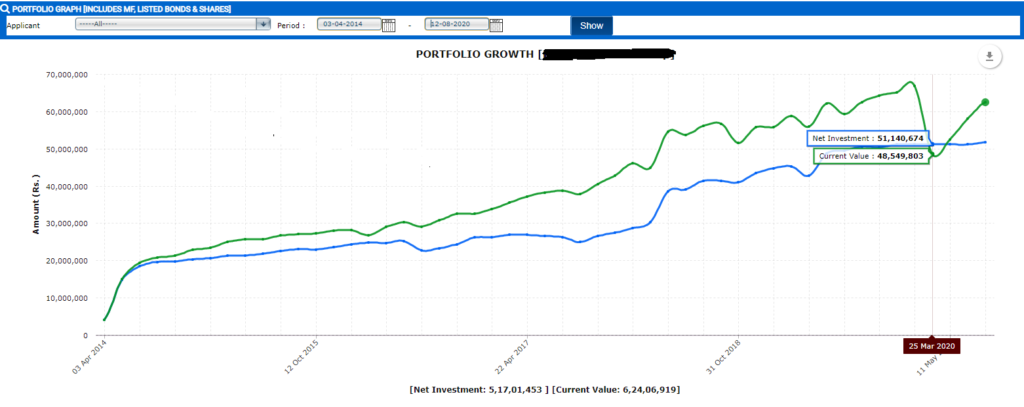

In the image below, you see a steep fall in the portfolio on March 25th. In fact, the value of her holdings breached the cost price of investment was in negative territory. But we didn’t panic.

The Rewards of Staying put

It takes attitude, belief in the process, and mettle to stay the course, even more so in turbulent times. The way to do this is to let your investment goals be your guiding light and reveal the path of reasons to stay invested.

Mrs. S did this, kept her goals in focus, and chose to stay put. You see the benefits of her decision to do nothing in the image below – her portfolio bounced back from Rs. 4.8 crores to Rs. 6.2 crores in 5 months. This is only Rs. 20 lakhs short of the all time high of Rs. 6.44 crores.

In the world of securities, courage becomes the supreme virtue after adequate knowledge and tested judgement are at hand. – Benjamin Graham

When it comes to advising, ours is based on investor temperament and the needs of the family. Our calls for you are guided by our understanding of you as a unique individual. We counsel all our clients to invest in a manner that is focussed, goal-driven, and vision-based.

Put simply, this is the quote that captures how we think about equity investments – ‘Buy a stock the way you would buy a house. Understand and like it such that you’d be content to own it in the absence of any market‘. – Buffett