This is a routine case study to bring home the point about staying put with your investments. But routine does not make it useless. Quite the contrary. Strongly, too.

The brilliance of doing nothing is oft-ignored. Oft-underestimated. And we have not pursued often enough. Hence, the need to share this case study and illustrate its truth. Please note real client story. Not real names.

Active vs Wise Portfolio

We have many types of clients. Some clients feel the need to make changes in their investment portfolio all the time. Others are not like that. Which client portfolio earns better returns?

Here we compare two sets of portfolios. Let’s call them Mr Active and Mr Wise.

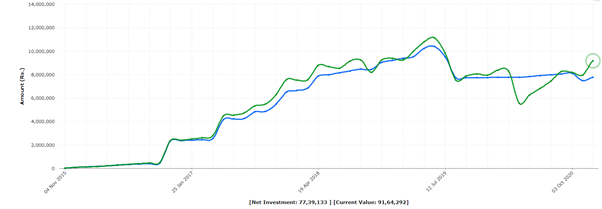

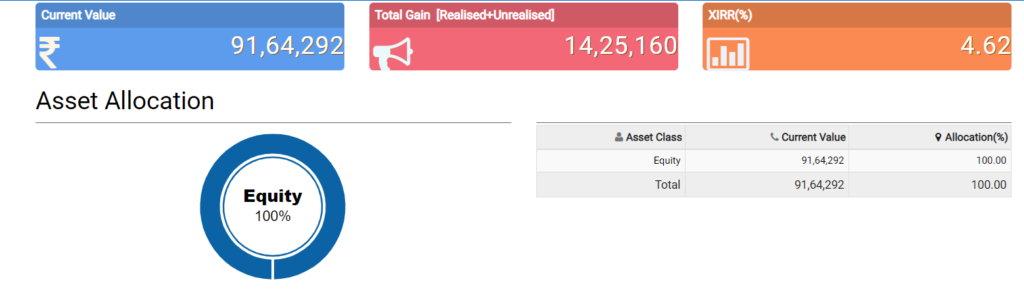

Mr Active started investment in 2015. We started the investment journey after understanding goals and needs. After 3 years or so, the portfolio accumulated to sizeable 8 figures. Mr Active was not settled with the path of staying invested. Kept looking out for better and better returns. That made for changes in the investments and type of funds many times. We invite you to see Active’s investment line in Blue. The Green line indicates market value.

Active’s annualised return after 6 years of investing is around 4.62% – shown in the graphic below.

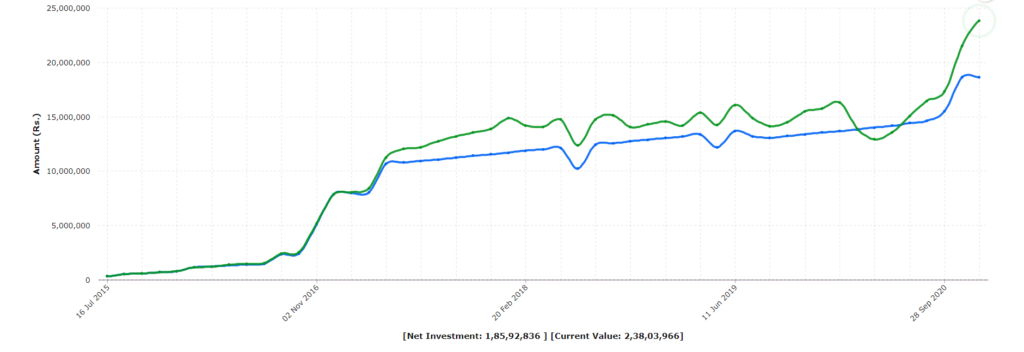

Coming now to Mr.Wise.

Started journey at similar time. Stayed put during the entire course with monthly investments. Portfolio going linear with additions seen in the blue line. The portfolio simultaneously accumulated market gains as seen in the green line.

Lesson: Disciplined investing and staying invested gives better returns. What’s more, during the crisis in March -April, Wise stayed put, the result of which is the handsome gain in the portfolio.

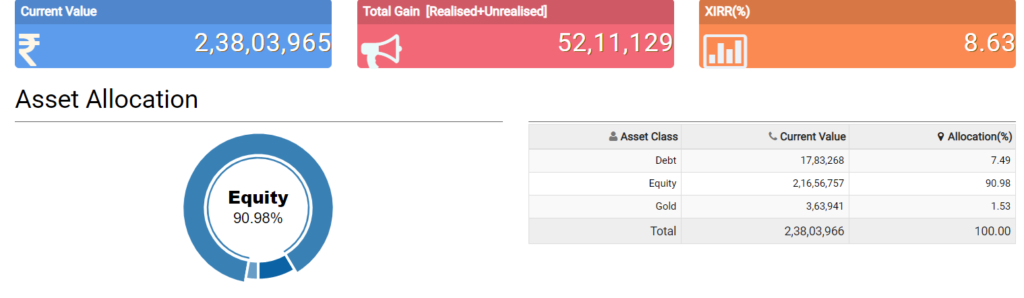

Mr Wise has accumulated annualised returns of 8.63% as seen below. The gain of 4% more is the advantage of overall portfolio growth.

Having a long-term view and staying resilient all the time is the key to get better returns. Don’t give your anxiety to your money. Leave that to professionals to take action when it is warranted. More money is made by doing less.