Meet Ms. M. She is an investor with a moderate risk appetite. This is her investment portfolio. It comprises a combination of funds. The funds have been chosen only after considering her risk appetite.

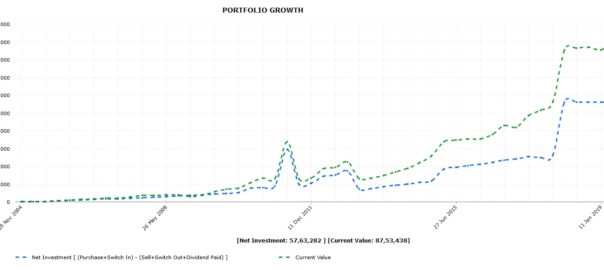

Visual of line graph We have been planning Ms. M’s finances for the past 15 years. During this period, Ms. M’s life has experienced quite a few ups and downs. And so has the market. Despite this, Ms. M’s portfolio has grown at a steady rate of nearly 10% per annum over the 15-year period. This period includes times when Ms. M, faced various personal and professional challenges. We understood her needs at every stage in life and personalised her investment strategy accordingly.

In Equity We Trust

As mentioned, Ms. M is an investor with only a moderate risk appetite. We have been helping her select funds which suit her profile and the need to be in equity. We firmly believe that calibrated investing in equity for the long term is always fruitful and delivers above average returns. Ms. M’s portfolio is proof of this. Ms. M. started investing in 2004. She began small. She invested regularly – every month, year after year. The results of doing so are evident in the chart above.

Numbers Don’t Lie

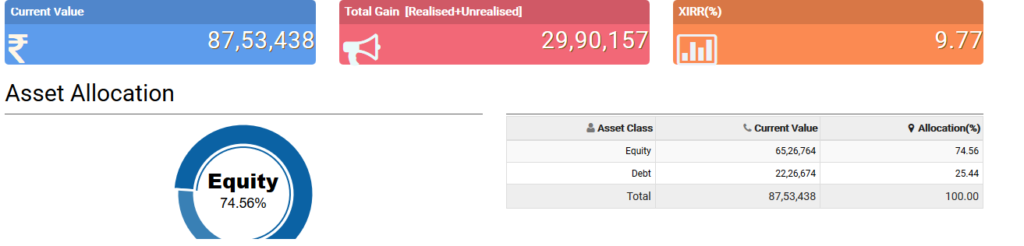

The current market value of Ms. M’s portfolio is approximately Rs. 87 lakhs. The net investment is Rs.57 lakhs. The total gain in absolute terms is around Rs. 30 lakhs. Asset allocation as seen in the table is 75% in equity and the balance in debt. The average compounded return is 9.77% per annum over a 15-year period (XIRR is a good measure of returns when investments done are not linear for given period).

Another crucial thing to keep in mind here is that Ms. M gradually increased the quantum of investment over this period of time. This is a vital aspect of Financial Life Planning – growth in our net worth has to correlate with our income growth and changing needs.

The second thing we’d like to bring to your notice is this: even after the recent market downturn of 10-15%, this portfolio is stable and still showing steady returns that are close to double digit. Very few other investment avenues offer you this.

The Bottom Line

Yes, Equity is volatile, but only in the short term. Well defined investments in equity, not speculation, are always prudent for the long term. It has been proved time & again that – ‘You can be sure equity will give you better returns than any other asset class’. Ms. M’s portfolio proves this conclusively.

Great work and hand holding.