Happy New Year, friends! New Years is a time for resolutions. And we intend to keep them, right?

Wanting to do something and Doing something are two different things, we know. And that’s the first thing we must remind ourselves.

Every year, many of us resolve to eat better, exercise, track expenses, etc. But in reality, we fail to keep up.

Action takes the cake.

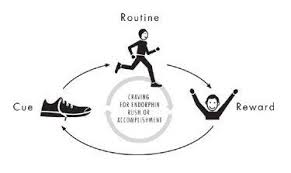

Let’s see how–Our brain is lazy to adopt new things, new habits. To act, we need to preempt it to get into action. To form new habit, we need to get into the habit of action, action, again and again. This makes The Habit Loop.

The Habit loop is very well explained by Charles Duhigg in his thought-provoking and action-inducing book ‘The power of habit’- Why we do what we do in life and business.

If we want to form a new habit, we need to action repeatedly and get rewarded for doing so. This thought, action, reward cycle is the basis of habit forming and The Habit Loop. For e.g. We want to exercise and stay fit. Shoe becomes a cue for action, and result of running you get reward in the form of rush of Endorphin, the good mood and a good day!

It’s easy when you tell your brain it is. The brain gets the message and moves the body into action, at the end of which, there is a reward.

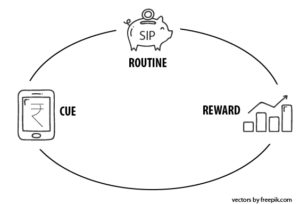

Case in point: If we decide to save more spend less. It will not happen on its own. When money gets credited to your account, it remains idle unless you invest. Salary credit is a cue to routinely transfer to invest. Big accumulated corpus is a reward.

Actions build momentum to fulfill the resolve and it initiates a reward

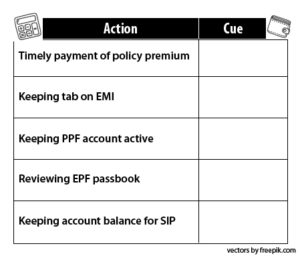

For a happy life and personal finance, in particular, which helps achieve a happy life, the execution is the key. Think of the cues for each action point so your brain will get you to take action on each of these pain points to get reward of controlled financial life.

Let’s turn managing personal finance into a repeated action to habit loop. And enjoy the rewards of Happiness and Peace of mind.