In a troubled time where the economy is hitting an all-time low, there is uncertainty around and you are looking to invest, the question on every investor’s mind is what should I invest in?

At the same time, Gold is hitting new peaks. Central banks are loading the treasury with more gold positions. Investment demand for gold has increased over the last several months. We have been getting enquiries on investing in Gold, Which brings two questions: why gold and is now a good time to invest in gold? Let’s get into it.

Is it the right time to invest in Gold?

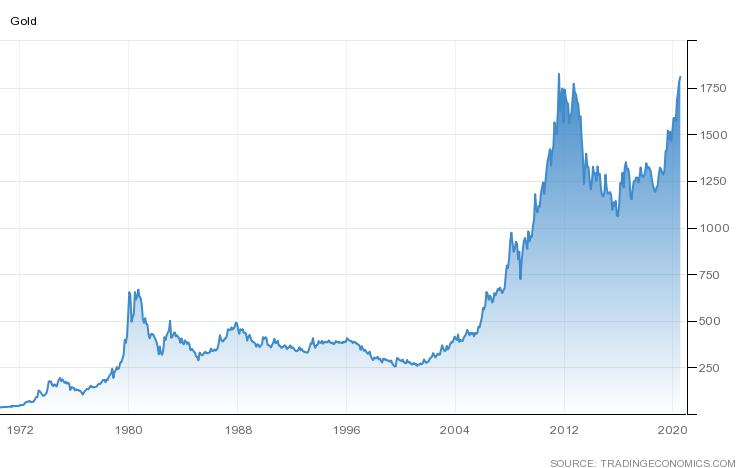

Over the last 50 years, the price of gold has steadily risen from Rs 184 per 10 gms to Rs.50,000 per 10 gms. Today gold is trading at Rs.5,062 per gram.

The data reveal that gold is a sound, steadily rising investment option. There’s no question about that. Keeping that in mind, should your next investment be in gold? To answer this we need to investigate what are the things that affect the price of gold and how are these factors looking now.

The factors that influence the gold prices are :

- Interest rates affect the price of gold. Currently, interest rates are low.

- Economic prospects affect the price of gold. They are uncertain now.

- Inflationary pressures affect the price of gold.

- How much gold the central bank buys affects the price of gold. Demand for other avenues of investment affects the price of gold.

- Geo-political factors affect the price of gold.

All these factors are very much in play now.

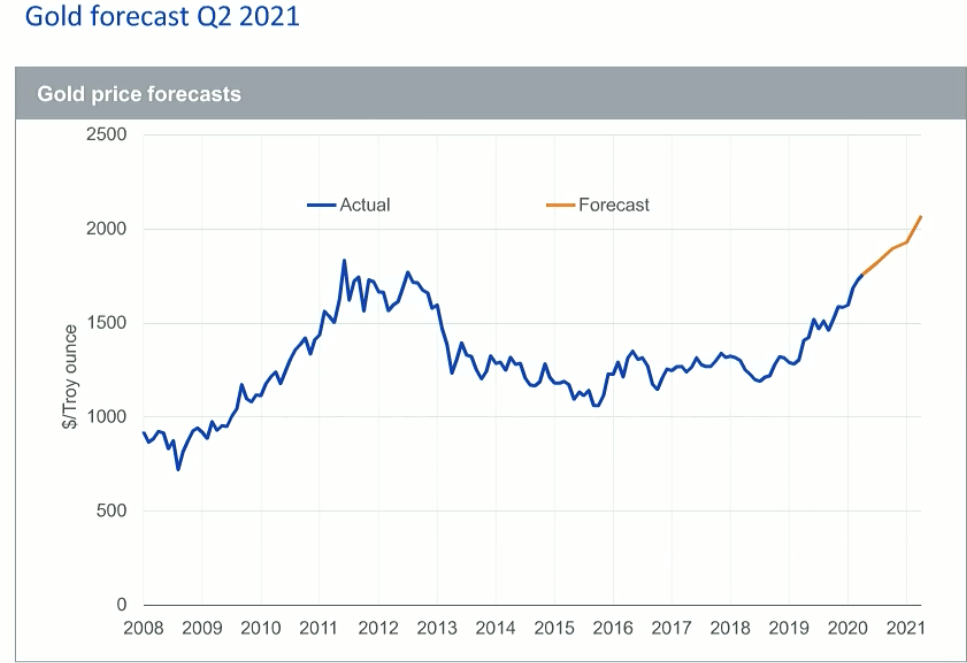

What is the outlook on Gold?

To understand what lies ahead, it helps to look back a bit. A quick examination of the economic history of India since the 70s is instructive. Briefly speaking, this is what has happened during the past 50 years.

As you can see, history does seem to be repeating itself and, as a consequence, gold prices are on the way up again. Which brings me back to the all-important question: is now the time to invest in gold? The simple answer to that question is yes. In the medium term say over the next 1-2 years, gold looks like one of the more promising places to park your money in.

How should I invest in Gold?

So how should you go about investing in gold? In other words, what is the most convenient way to add gold to your investment portfolio? You have two options: Gold funds and Gold Mining Equity Funds

- Gold Funds are offered by most of the mutual funds. (HDFC Gold Fund, SBI Gold Fund, ICICI Gold Fund etc.)

- Gold Mining Fund is an equity fund investing in equities of gold mining companies. In India, the DSP World Gold Fund offers this. One gets to participate in the best gold mining companies equities. Please note that this is a feeder fund into Blackrock Global World Gold Fund. Investors with higher risk appetite to participate in the gold prices can consider this. Gold mining companies usually deliver good performance when gold prices are in an uptrend. Gold miners benefit disproportionately from the increase in gold selling price.

Bottom Line – The last time we were keen on Gold was In 2010-11. We had recommended having a gold allocation, from 2012 it had many volatile turns, we see in 2020 Gold will have a good outlook. We suggest having 5-10% of portfolio allocation to Gold. To summarise why to have gold allocation now –

- If your portfolio doesn’t include investment in gold, this is an opportune time to diversify and add security to your investments with an infusion of gold.

- Macro-economic factors are favourable

- Reduces the volatility of your portfolio.