Combined contribution above 7.5 lakh in PF, NPS and superannuation fund would be taxed from 1 April.

The Budget has been a shock for high salary earners. On the chopping board is a critical tax benefit. If the employers combined contribution to the Provident Fund, National Pension System and superannuation fund exceeds Rs.7.5 lakh a year, the excess contribution would be taxed from 1 April 2021. Earlier, there was no such ceiling.

Till now, individuals with high basic salary could have the employer contribute up to 22% of the basic towards PF and NPS (12% and 10%) and up to Rs.1.5lakh to a superannuation fund and avail tax exemption on the entire amount. Any contribution to an approved superannuation fund by the employer over Rs.1.5lakh was treated as perks in the hands of the employee. Now even the interest and dividend earned on the excess contribution during the previous year will become taxable.

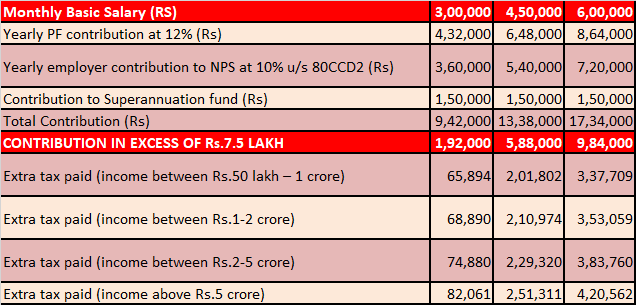

The proposal will increase the tax liability of high earners. For instance, for an individual with monthly basic of Rs.3lakh, the mandatory 12% PF contribution will come to Rs.4.32lakh for the year. if he has also opted for employer contribution to NPS, 10% of basic totalling Rs.3.6lakh will be deployed in NPS. His aggregate contribution will be deployed in NPS. His aggregate contribution will come to Rs.7.92lakh. Under the proposed law, Rs.42,000 will be taxable. For those earning in excess of Rs.1 crore a year, this is an added burden as they already pay much higher effective tax. Their excess contribution will also be taxed at this rate.

How ceiling on tax exempt contribution will impact the wealthy

The ceiling has been introduced as the government feels it gives undue benefit to individuals earning a high salary. Such people design their pay package in a manner that allows for large chunk of the salary to be directed to these avenues. Since this contribution is not taxed at any level, a sizeable portion of the salary is kept out of the tax net. “This portion of the salary does not suffer taxation at any point, as EEE regime is followed. Not having a combined upper cap is not desirable,” the Budget says.

Financial planners say high salary earners have no recourse to reduce tax liability. There are no alternative that can be considered to replace contributions beyond Rs.7.5lakh. The changes are a double whammy for individuals in high tax slabs, says Prableen Bajpal, Founder and Manging Partner, FinFix Research and Analytics. “On one hand, options to rejig the salary structure will be limited, while on the other, there is additional work to be done to meticulously check which tax system an individual should opt for.”

However, planners says even if tax saving at entry level becomes difficult, salary income should be diverted to avenues that can fetch high, tax-efficient returns.

One of the tweaks is contributing to the Voluntary Provident Fund. The VPF is an extension of the EPF and allows individuals to contribute beyond the 12% threshold. It fetches the same rate of return (8.65% at present) and enjoys EEE status for taxation. Individuals can contributing up to 100% of the basic towards VPF. Those with high salary can ask their employers to replace other contributions (apart from PF) with VPF. This can be a very effective tool to enhance retirement corpus, given the safety of assured return and tax-free status. Says Archit Gupta, Founder and CEO, cleartax, “High income earners must add to the PF themselves through VPF. There is no upper cap, so one can contribute to the extent of basic salary plus DA. “Although it won’t help in reducing taxable salary at entry point (as deduction clubbed u/s 80C), it should be considered as there is no limit on contribution and the funds grow at the same rate as EPF, with proceeds as tax-free on maturity, points out Bajpal.

However, VPF comes with withdrawl restrictions. Full withdrawl is permitted only at the time of retirement. Also, do not ignore goals and asset allocations while increasing contributions. VPF is useful for those nearing retirement and who seek safety by increasing their debt portion.

Those keen on maintaining the NPS contribution for its higher equity exposure should consider own contribution, beyond what is contributed by the employer. There is no upper limit to contribution in NPS if its your own money. “it would be good to self-contribute in NPS even though maximum deduction is only to the extent of Rs.2 lakh through 80C and 80CCD(2). “Suggests Gupta. Under the ‘active choice’ mode of NPS, Subscribers can maintain higher equity exposure (maximum 75%) until age 50 which moderates gradually thereafter.

This article first appeared in The Economic Times Wealth. Reproduced here for our readers.