Navigating finances can feel daunting, can’t it? Conversations about investing, planning for retirement, and setting financial goals often get pushed to the back burner, just like the promises we make to ourselves about starting someday. But what if we shifted our perspective? What if today became our Day One? In community circles, I often hear […]

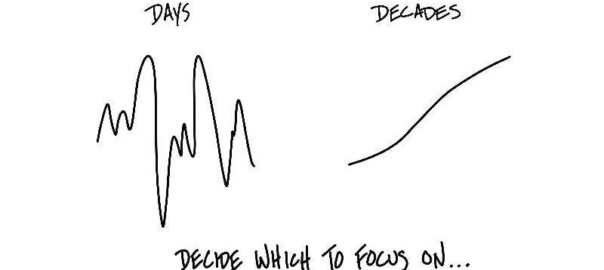

Why do we procrastinate starting investments?