‘Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.’ – Warren Buffett. With the Franklin India Opportunities Fund, let’s explore how the strategic insights meet India’s dynamic markets, paving the way for enduring financial growth.

What is the India Opportunity Fund?

A fund that seeks Opportunities in “special situations” that companies might encounter occasionally. These situations could include corporate restructuring, shifts in government policies or regulations, and similar events. Give example: Power demand in the country is increasing and the fund manager has rightly allocated to many of the names in this sector (REC, NTPC, NHPC).

Why Franklin India Opportunities Fund?

- The Franklin India Opportunities Fund distinguishes itself through its focused approach to specific themes, dynamic allocation across multiple themes, and disciplined portfolio construction.

- The portfolio’s current theme allocations are Digitalization at 18%, Make in India at 39%, and Sustainable Living at 27%, with the remaining 17% allocated to Other Exposures and Cash.

- The fund is on the lookout for unique “special situations” that companies may face from time to time. These situations present an investment opportunity to a fund manager who can foresee and interpret the implications of that opportunity.

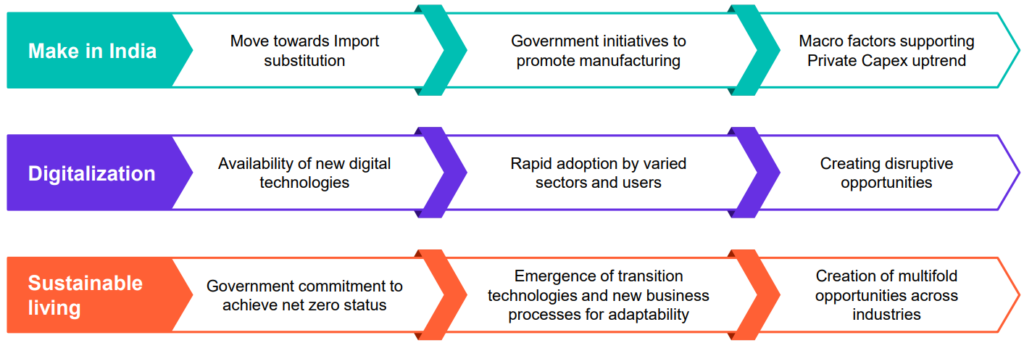

Dynamics that validate the special situation opportunities available in these themes:

India’s Digital Drive and Economic Growth Initiatives:

- Digitalization transforms how every industry works by connecting people, organizations, and machines. India’s initiatives like India Stack, OCEN, and ONDC drive digital advancements in payments, credit accessibility, and online consumer support.

- The government’s focus on job creation, consumption boost, and local manufacturing in Defense, Solar, and Consumer Durables aims to spur domestic growth. Initiatives like the ‘China plus one’ strategy and increased domestic capital spending align with this.

- The Production-Linked Incentive (PLI) drives import substitution, job creation, and export orientation, and attracts global firms set up in India.

Why invest in the Thematic fund?

Investing in thematic funds offers focused exposures to specific themes or trends, potentially driving higher returns independent of broader market movements. This approach can provide unique opportunities that might bring in different profits compared to what the whole market is doing. Though the fund sounds thematic, we think it is well-diversified across different themes in one basket.

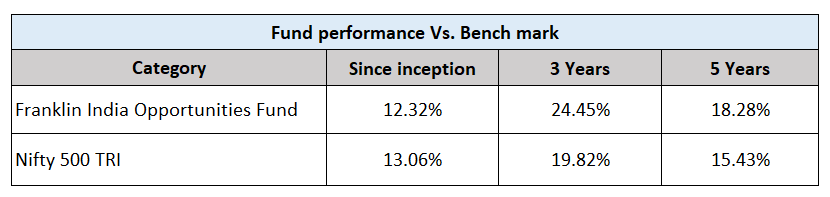

Fund performance:

The above table shows the fund’s performance over its Benchmark: Nifty 500 Index.

The scheme is managed by Mr. Kiran Sebastian, Mr. R. Janakiraman, and Mr. Sandeep Manam. The fund manager actively selects stocks within specific themes, identifying special situations that generate strong cash flows for companies and drive stock price growth. This approach combines elements of both ‘growth’ and ‘value’ investing strategies. Identifying sectors that address the ongoing demand is key to the fund’s performance. Kiran here has done an excellent job doing this the right way.

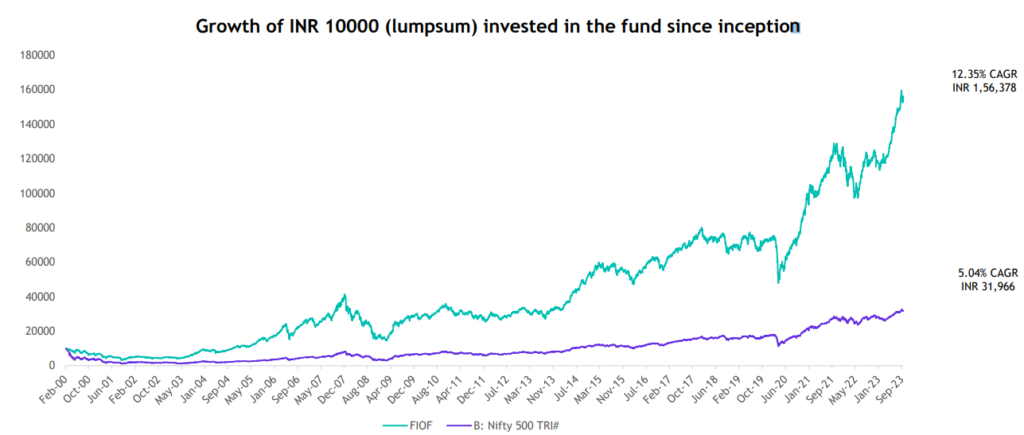

The above chart represents the performance of the fund from its inception (2000) till date presenting how Rs. 10000 invested has become Rs. 1.56 lakhs over the years providing a return of 12.35% CAGR.

Who Should Invest?

- The Fund is a good choice for investors who are willing to take on high risks in exchange for the chance to earn high returns.

- An investor who is ready to stay invested for five years or more, such an investor can consider investing in an equity scheme that is based on special situations investing.

- It is also a best-suited fund to start investment through a Systematic Investment Plan (SIP) approach.

Our Thoughts

Most investors prefer investing after they have achieved some clarity over how events pan out. However, history is proof that greater uncertainty can lead to higher rewards. In line with this view, The Franklin India Opportunities Fund stands out by seizing unique chances in changing situations. With focused themes and diverse opportunities, it offers distinct investment possibilities outside the regular market trends. It clearly captures the main reforms that the government is targeting for India to become a much more progressive economy in the coming years.

If you would like to Invest in the potential of tomorrow’s leaders today, contact us at 9845093554 and ask for Ravi.