During one client conversation, the question came up, should we invest in the Sukanya Samriddhi Account? This is one case.

Explainer: The client is investing in his company stocks for his child’s education. He has a long term vision, time for the goal and a good risk appetite. Investing in stocks is a good idea for him. Blocking funds in the Sukanya Samriddhi account is not. That doesn’t mean one idea is better than the other, just that the investment option’s Suitability depends upon your situation.

In another conversation, the client’s retired father discussed investment options – why not NPS, why not annuity?

Explainer: Retirement income is a compassionate issue—Liquidity, safety and ease of doing transaction matters. There is a wide range of options, and all can not be put in your basket. If your risk appetite is low and liquidity is high, then Annuity and NPS don’t suit you as they are not very liquid. There are better-assured return options – like Senior Citizen Scheme – with relatively higher liquidity to access capital if needed.

Another intriguing request was – Please make changes in My EPF contribution in the retirement plan as Govt announced a tax on my EPF interest.

Explainer: When, during the annual review, the client suddenly said, “Change my EPF numbers for retirement planning because interest is now going to be taxed.”, I explained to him the provision that only if your contribution is more than Rs 2.5 lakhs in EPF per annum is the interest taxed. Based on our calculations, the client will get there only after ten years. As a result, we advised and agreed that there was no need to do anything now.

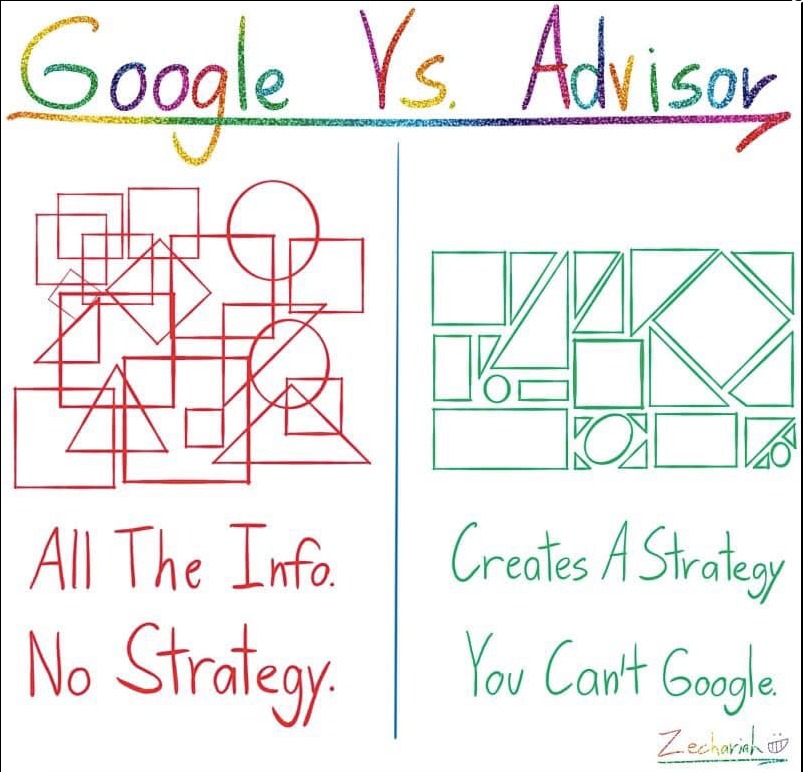

Information is all over the place like never before. Mind it.

Personal finance is one of the most searched terms on the internet. It is often trending in social media.

The Pandemic has revealed a social boom – in investments and personal finance decisions.

But is the information available on the web about various investment options directly related to you?

We make an effort to explain to our clients when they come to us with information because information can mislead and overwhelming.

Simply put, don’t make investment decisions just because of something you’ve read on social media. Or you heard through the grapevine.

Contextualise it. Personalise it to your need, risk appetite, return requirement, and the like. Remember, you can’t take Crocin for every fever.

Merely consuming and acting on any information is injurious to the health of your money.

We don’t treat ourselves by only reading WebMD. You need a trusted professional to decipher and filter the noise of information and turn it into the sweet song of your life.

Always contextualise and customise information, for they are like scattered pieces of cloth that need to be stitched into a suit that fits you to a T. Only an investment professional can do this for you. Welcome.