Canara Robeco Equity Hybrid fund can invest in equity and debt in 75:25 proportion. It brings the best of equity and debt asset class. The equity portion helps to get returns, and the debt portion provides a cushion. An aggressive hybrid category is less risky than a pure equity fund but can potentially offer equity returns in the long term.

- ASSET CLASS: Hybrid

- CATEGORY: Aggressive Hybrid Fund

- HORIZON: Medium to long term

- FUND MANAGER: Shridatta Bhandwaldar

- LAUNCH: 30-Nov-2009

- BENCHMARK: CRISIL Hybrid 35+65- Aggressive Index

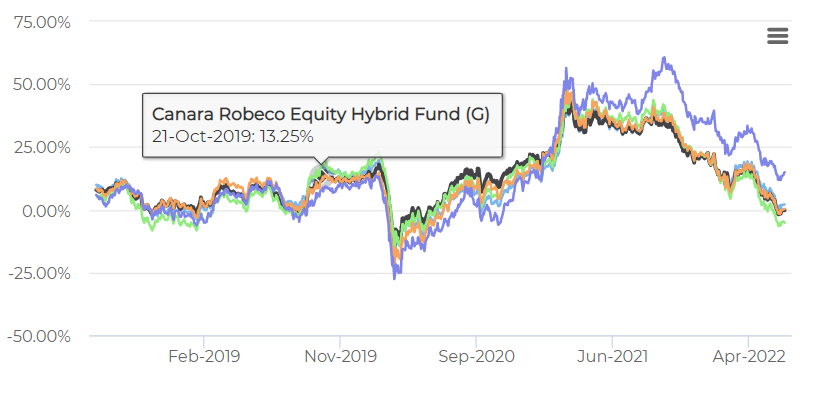

Fund Performance

The above chart shows that the fund has a good track record of delivering positive returns almost 90 times over the last 5 years.

In investing, being consistent with low volatility is more important. Canara Robeco Hybrid Equity fund delivers that – its average rolling return over the previous 5 years is 13.37%, with average volatility of 12.04%. This proves our case of having a fund with a better average return with low volatility.

Note: The above list of top 5 aggressive hybrid funds has been arrived at by analysing the following parameters. (1) Rolling Returns- Rolling return is calculated for a particular period continuously (or fixed frequency). Rolling returns can offer better insight into a fund’s more comprehensive return history.

(2)Positive % – It represents the fund’s frequency of generating positive returns historically.

Who should invest:

- First-time Equity Investors: to experience the flavour of equity

- Investors with a 3-5 years Investment Horizon: Having a definite goal

- Investors who are near their retirement age: to earn inflation-adjusted returns

Why invest in Canara Robeco Equity Hybrid Fund?

- A good balance of equity and debt ensures better returns than a debt fund with less risk. The fund manager ensures automatic rebalancing between equity and debt as per the economic situation.

- The investor gets an equity taxation benefit, i.e., only long-term capital gains are taxed in a year above Rs. 1 L.

- With the current scenario of rising interest rates and a volatile equity market, this fund makes a case for investing.

great insights!

thanks!