The Union Budget 2024’s theme of “Vikasit Bharat” reflects a holistic approach to economic development, focusing on Employment, Skilling, MSMEs, and the Middle class. By addressing these critical areas, the budget aimed to create a more inclusive and prosperous economy, paving the way for sustained growth and development.

Let’s decode all the tax announcements from Budget 2024, specifically those impacting your life.

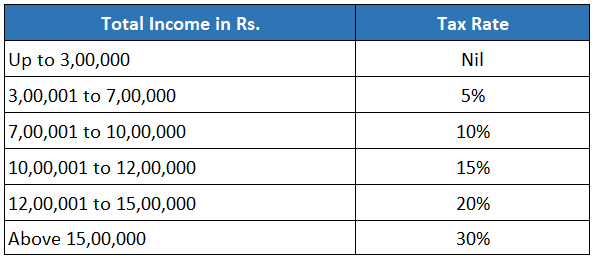

- For those opting for a new tax regime.

- Budget increased standard deduction of salaried employees from ₹ 50,000/- to ₹ 75,000/-

- Deduction on family pension for pensioners enhanced from ₹ 15,000/- to ₹ 25,000/-.

- The new tax regime rate structure is also revised to give salaried employee benefits up to ₹ 17,500/- in income tax.

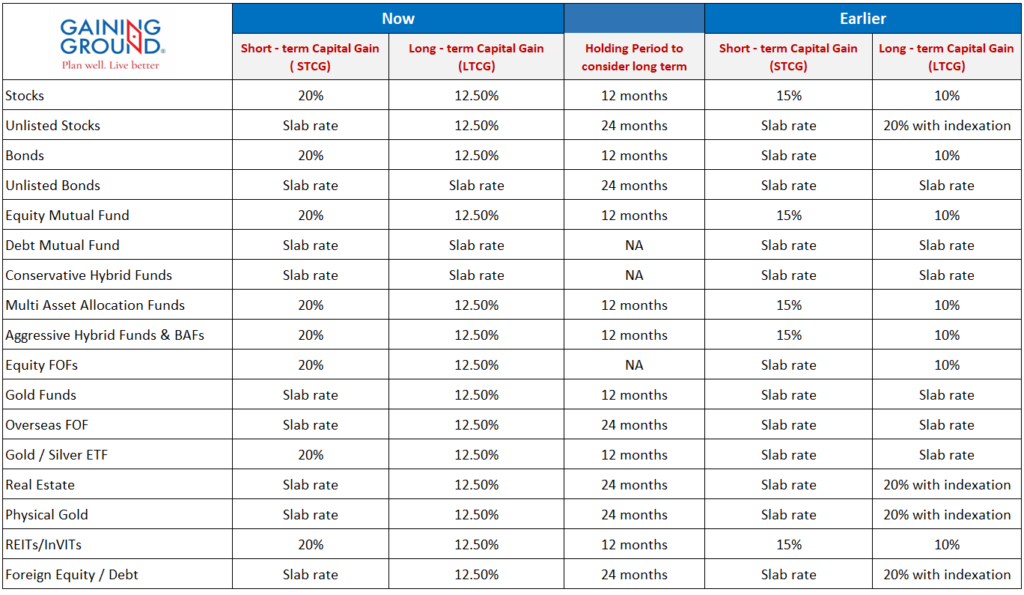

- Changes in Capital Gain Tax:

- Long-term Capital Gains (LTCG) on all financial and non-financial assets will attract a tax rate of 12.5% from the earlier 10%. Additionally, the limit of exemption for capital gains will be set at Rs 1.25 lakh per year.

- Short-term Capital Gains (STCG) have been hiked on listed equity instruments from 10% to 12.5% and from 15% to 20% respectively.

- Indexation benefits for gold and immovable property have been removed, although LTCG on these instruments has been reduced from 20% to 12.5%.

- Also, the holding period for Gold, unlisted bonds, and debentures has been lowered to 24 months for the classification of Long-term capital assets.

Here’s our balanced view of the increase in capital gains tax.

The impact of higher capital gains taxes on a fast-growing economy may not be significant. This move will slow down the recent surge in retail derivatives trading, thereby discouraging short-term speculative investing.

- Raising STT to reduce retail F&O: Activity Securities Transaction Tax (STT) was hiked to 0.1% on the sale of options and 0.02% on the sale of futures.

- Gains originating from the Buy-back of shares have been made taxable in the hands of the recipient. So far they used to be tax-free as companies paid the tax on conducting buyback.

- Changes in the NPS:

- The deduction for the employer’s contribution in the new regime raised to 14% from 10% for both private and public sector undertakings.

- NPS Vatsalya – a plan for contribution by the parents and guardians of minors will be started.

- Buying gold and silver will be cheaper now as the customs duty has reduced to 6% from 15%.

- Custom duty on platinum has reduced to 6.4% from 15.4%.

Thus, these are the major highlights of the Budget in Amrit Kaal that will impact your personal finance and taxation.

Key Sectoral impact:

The industrial sector can benefit from the budget in several ways. The continued focus on infra development including roads, railways, and ports can enhance logistics. Support for MSMEs and Manufacturing with enhanced credit schemes and supply of skilled labor that is essential for industrial growth. Incentives for renewable energy projects can help industries reduce energy costs. All these foster a conducive environment for industrial growth and drive economic development.

Sectors expected to benefit include consumer goods, financial, real estate, autos, telecom, mobile manufacturing, agriculture, and MSMEs.

In conclusion

Infrastructure, Manufacturing, Industrials, and consumption will continue to drive the growth of the economy. We think over the next 3-5 years diversified equity funds and thematic funds that capture these sectors along with funds that invest in companies in the innovation space will do extremely well. The mid and small-cap segment with broad-based growth should add significant returns to your portfolios. We think this budget fosters growth and drives economic development.