Let’s decode all the tax announcements from Budget 2023, specifically those impacting your life.

- First and foremost, a new tax regime for individuals to now be the default tax regime –means you have to mention to make you part of the old regime specifically.

- Another point making the new regime more attractive is a rebate under section 87A has been enhanced from ₹12500 to ₹25000 from the current income limit of ₹5 lakhs to ₹7 lakhs. Thus, individuals opting for a new income tax regime having income up to ₹7 lakhs will not have to pay any taxes.

- Standard deduction benefit of ₹52500 for salaried extended under new tax regime. Remember that popular deductions are not allowed in the new regime.

- The limit on tax exemption for leave encashment is increased from ₹300000 to ₹2500000.

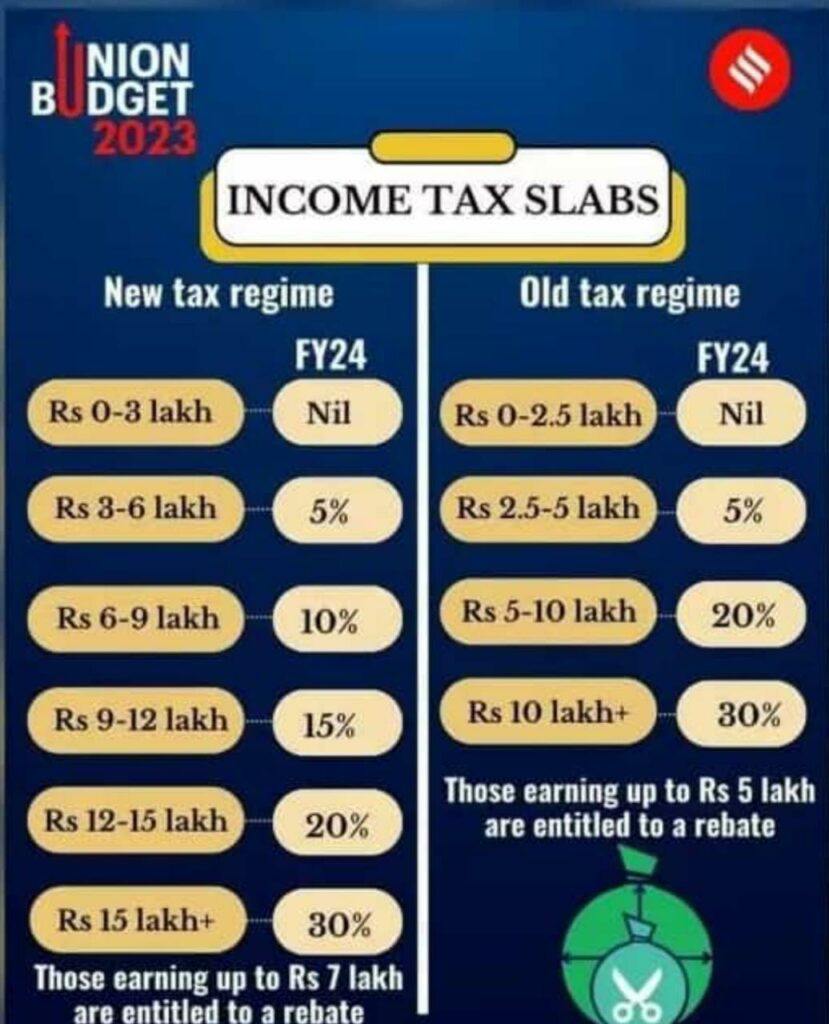

- Under the New Tax regime, the number of tax slabs was reduced from 6 to 5 slabs, thus increasing the slab rates. While in the old regime, anyone earning above Rs. 10 lakhs would fall under the 30% bracket. The new slab is as follows:-

- For high-income earners of Rs. 2 crores and above, the highest level of surcharge rate has been lowered from 37% to 25% in the new tax regime. This would result in the reduction of the maximum tax rate from 42.7% to 39%.

- Let’s understand the housing part, Long Term Capital Gains > ₹10 Cr will not benefit from Sec 54F. This means if you sell a house/ stake in a company, and gains are more than ₹10 Cr, then the max benefit is up to ₹10 Cr when you invest in another property, etc.

- The most contentious aspect of this budget from a direct tax standpoint is insurance policies (Not ULIPs); the traditional plans will attract tax if the total cumulative premium is > ₹5 lakhs in a year, and an aggregate premium is issued on or after 01/04/2023. The incremental income or the Proceeds are now taxable (For ULIPs this was already at ₹2.5 lakhs).

- Presumptive taxation under section 44ADA (Professionals), the receipt limit increased from ₹50 lakhs to ₹75 lakhs, provided receipt in cash does not exceed 5%

- If you have been investing abroad through LRS (Liberalized Remittance), the TDS has increased to 20%. This will be a big impact. Earlier, TDS was only 5%, and that too if > 7 lacs. Now it is flat 20% Impact – Negative for global investing if you are buying global securities or transferring money outside India using the LRS route.

In a nutshell, these are the major tax announcements made in the budget that you need to consider.

Now let’s see the investment avenues proposed in the budget:

- Mahila Samman Bachat Patra‘s one-time new small saving scheme for 2 years till March 2025. Deposit facility up to ₹2 lakhs at a fixed interest rate of 7.5%. A partial withdrawal option is also available.

- The budget also enhanced the maximum deposit limit for Senior Citizen Saving Scheme to ₹30 lakh from 15 lakhs earlier.

- The monthly income scheme (MIS) investment limit increased to Rs 9 lakh, up from Rs 4.5 lakh, for a single account. For joint accounts, the limit has gone up to Rs 15 lakh, up from Rs 9 lakh.

Thus, these are the major highlights of the Budget in Amrit Kaal that will impact your personal finance and taxation.

The budget intends to boost the economic output by providing Rs.10 tn for capital expenditure, 100 critical infrastructure projects in transport, and 50 new airports, develop tourism to increase local jobs, and thrust on skill development. The budget is inclusive for the new age technology companies and startups. Eye on growth is managed finally by keeping a tab on the fiscal deficit (Govt income minus expenses) and reduction in subsidy. All in all, it is a more reformist budget than a populist which will maintain the growth momentum of the market.

On the personal income front, it is sensible to adopt a new tax regime for Income above Rs. 7 lakhs -15 lakhs and above. The call on regime depends on individual to individual if you claim deductions and exemptions. Overall It makes sense to revisit the salary structure, use provisions for leave encashments and invest for seniors at home.

The budget is always bittersweet in its own way, but the wise thing is to take the maximum benefit out of it by keeping all the provisions in mind and acting accordingly.

Overall, we think the budget is growth oriented and inline with the expectations of India becoming stronger in the fast growing economies in the world. To keep up this pace, this budget is making forward approaches in the process of building core themes in Healthcare, Infrastructure, Manufacturing, Education and financial services. The benefits of all these will significantly put India much ahead over the next 5-10 years.

We would be listening and attending to various fund managers on their views about how they are crafting or re-aligning the funds they manage and would help you to understand in the next note.

Nice and Crisp explanation Ravi. Thanks