Have you ever wondered about the nature of goals and how we arrive at them? Let’s explore these fundamental questions.

When it comes to financial goals, we at Gaining Ground approach them uniquely. We don’t just assign a monetary value to these goals; we delve into our clients’ backstories. Why, you ask? Because goals aren’t solely about money; they are intertwined with the emotions that drive them.

So, what determines our goals? Our goals as adults are influenced by the lives we’ve lived, the lessons we’ve learned, and the values we’ve embraced. Our past experiences directly impact what we envision for our future.

Take, for example, a common goal: saving for a child’s education. It may seem straightforward, but we uncover deeper layers when we meticulously plan for it. As our clients discuss whether a certain sum for graduation expenses is sufficient, we begin to understand their values. Values such as family, independence, and education choice all come to the forefront.

Consider another scenario: a client aiming to retire early. While the surface goal is early retirement, the underlying motive is to spend quality time with loved ones, underlining their strong family bonds, or to have more time for themselves for the things they love to do.

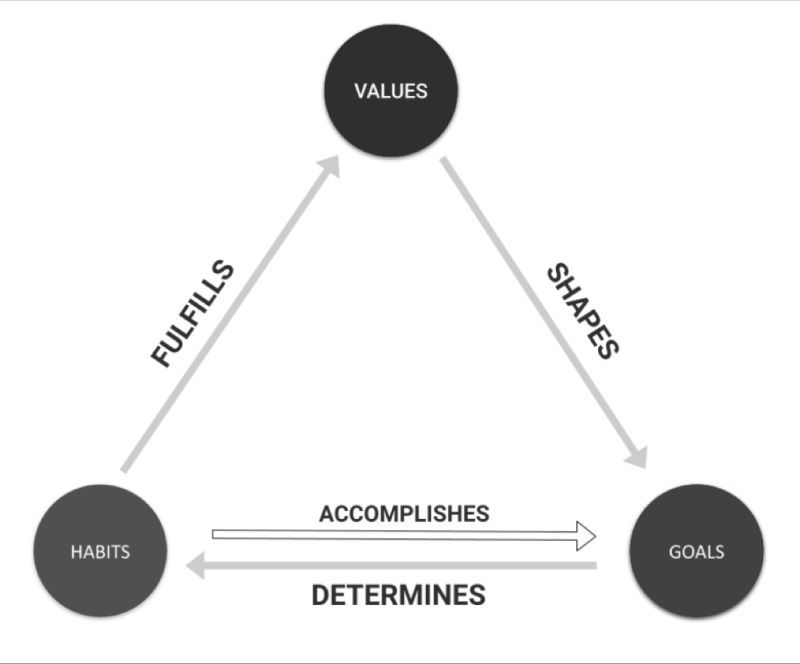

Beneath the surface of goals like child education, buying a home, retiring comfortably, or exploring the world lies a fundamental truth: our values, which shape why we pursue these goals.

As depicted in the accompanying image, values serve as the architects of our goals.

Goals serve as our guiding stars, directing our daily habits and routines. Let’s illustrate this with a straightforward example: valuing fitness leads to the purpose of maintaining or reducing weight. Regular exercise and a balanced diet have become ingrained habits in pursuit of the value of being fit. The connection between values, goals, and habits is crystal clear in this case.

Now, let’s pivot to financial goals. When Retirement Planning, vacation, or child education goals are well-defined and compelling, they become the driving force behind our saving habits. They motivate us to invest, potentially prompting changes in our daily routines to ensure we achieve these financial milestones. Thus, there is a dynamic interplay between goals and habits, each influencing the other.

Our actions and habits align with our values, and our goals are rooted in these values; as a result, our well-being/fulfillment/contentment increases. We feel good about ourselves and where we are. We also get a sense of life well lived, which is the true justice one can do to their earned wealth when we live according to our values.

While it may sound repetitive or generic, it’s worth emphasizing: finding your values is the key. Goals are defined based on values, and your consistent actions dictate your habits, which, in turn, determine and reinforce your values. It’s a cyclical process, and understanding this interconnectedness can lead to a more meaningful and purposeful life.