A client pledged his personal funds to invest in the business. Another channelled more than they could afford to keep a business going. Yet another couldn’t fulfil personal commitments because they invested too much in the business. A salaried client funded his wife’s business and the family suffered because the business didn’t take off as expected.

These are real cases of misplaced priorities. Of faulty resource allocation. Of emotional moves that are not thought through. They happen time and again. A financial advisor can only counsel against such mistakes. The onus is always on the person with funds to learn how not to let emotions drive resource allocation.

There is money. And there are different ways to use it. It’s important to allocate wisely. Mixing money for business with money for personal needs can hurt your life plans. How to get this equation right is what we are going to tell you.

Consider this: You are an entrepreneur. Your business needs money. So does your personal life. But you are not able to draw a line between the two calls for action. Because your business can sometimes make unexpected demands, you dip into your personal funds to meet business expenses. We have repeatedly served clients who grapple with this issue. It’s part of the challenge of being an entrepreneur – and advisor. The temptation to use all funds to meet the needs of business is hard to resist. It is something one should be very mindful of is our consistent advice to entrepreneur clients.

Understandable is the desire to use non-business for business under pressure. Business, too, for entrepreneurs, is their baby. In other words, very personal. Among other things, how to manage this dilemma is what we work with our clients to resolve.

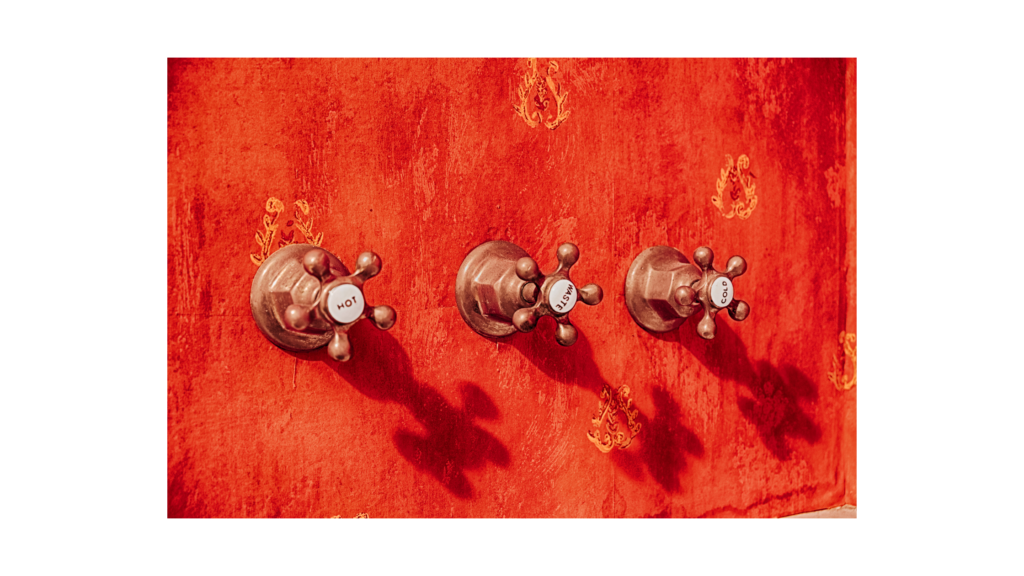

The Laxman Rekha Principle of Resource Allocation

One of our most vital pieces of advice is to tell our clients to create different buckets for each goal – education, retirement, emergency, health, marriage, home, business, and the like. We explain the importance of drawing a Lakshman Rekha between each of these buckets. We emphasise the perils of blurring these lines – no matter what. We urge them to respect the sanctity of the Lakshman Rekha. Doing so, we assure them, will keep them secure for life.

Is it easy to communicate or implement this advice? Certainly not. But clarity, resolve, and persistence can make it work – as it has for several of our clients. It is a state of being we help our clients achieve through gentle reminders, repeated assurances, and deeply personalised financial plans.

Points to remember

- Use buckets of financial resources or even (bank accounts) based on a commitment strategy grounded in life plans.

- The clarity in goal setting leads to clarity in resource application.

- Intelligence doesn’t necessarily mean financial intelligence. Depend on a financial advisor you trust.

- Make your investments countercyclical by Investing in other businesses through Equities

Neat and simple