It’s important to understand what Kind of returns Your investments are Giving.

Last week, my father called me to tell that my old LIC policy(my first job, first policy, the one we all buy to save tax) is maturing and that it’s giving me only 3.52 lakhs – as per his expectation money should have been doubled to 4 lakhs. He was upset that I was not getting enough by way of returns. In my mind, I know that for him money doubling – irrespective of the period it is invested – counts as good returns.

This is understandable.

Traditionally, we have been raised with belief that money doubles in deposits in 5 years. As a result, many of us cling to the fact that only when the money doubles does it count as a good investment. But in our pursuit for doubling the money, many forget the number of years it takes for this to happen.

Gone are the days of money doubling in 5 years in fixed deposits. What’s more, those days will never return.

As the economy matures, interest rates have come down. For an investment to double in 5 years it has to earn at least 15% per annum. This is a pipedream. Interest rates on fixed deposits, as you are aware, are down to 6-7%. For your investment in a fixed deposit to double at this rate, it needs at least 10 years.

The correct way to measure return on your investments is annualised returns, i.e. by how many percentage points investments are growing year on year for a given period.

When you see money grow from X amount to Y amount, what you are seeing is the rate of absolute return – this is how most of us see our investments in property. This is not real returns.

It’s only when you calculate annualised returns on the LIC policy, real estate etc., that you see real picture. And it will reveal that, more often than not, that the percentage rate of return is only in single digits.

The graph below shows how annualised returns for investments differ depending on the time period.

For example If you invest Rs. 10 lakhs and it grows to Rs. 1 crore in 10 years time, you will earn 26% returns, but if it takes 30 years, for 10 lakhs to grow to 1 crore, you are only earning 8% per annum.

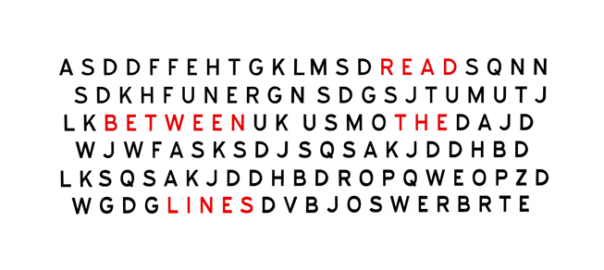

The bottom line: The next time you review your portfolio, read between the lines and look carefully before you claim you’ve earned good returns. The true measure of each investment type is annualised returns.