What is a Balanced Advantage Fund?

Balanced Advantage Fund, also known as Dynamic Asset Allocation Fund, is designed to provide investors with the benefits of both equity and debt investments while minimizing downside risks. These funds follow a flexible allocation strategy that aims to capitalize on market opportunities and cushion against market volatility.

How does it work?

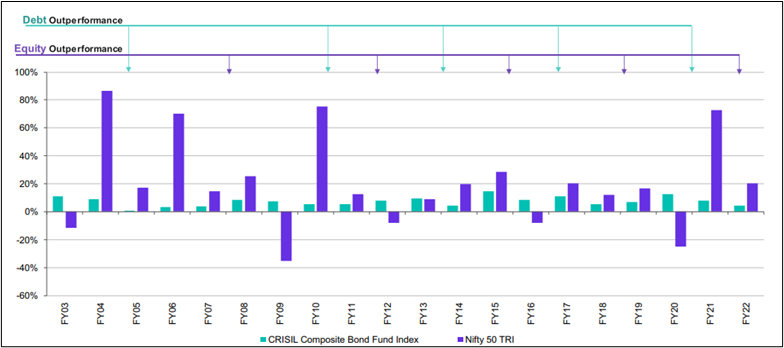

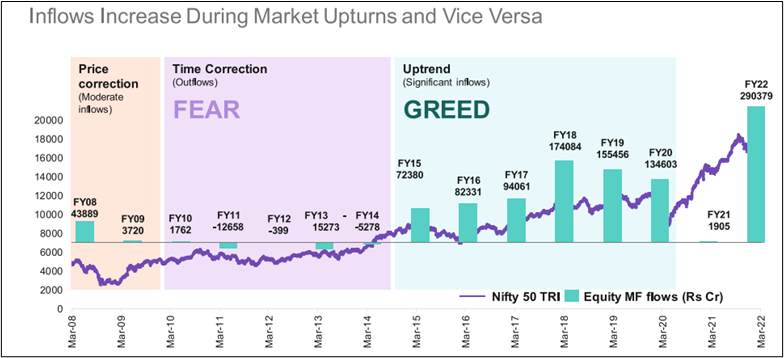

One of the primary risks that investors’ portfolios face is incorrect asset allocation during market fluctuations. It is conceivable that investors may end up with a conservative asset allocation when markets are very attractive and a very aggressive allocation when markets are unattractive. Because no single asset class continues to outperform or underperform.

One of the outstanding value additions that BAF offers to investors’ portfolios is helping them take appropriate risks when conditions are favorable and reducing risks when conditions are unfavorable. It mitigates the risk by providing a useful model for handling asset allocation, especially for equity investments where determining the appropriate allocation can be challenging. Investors tend to Buy high and sell low.

This dynamic asset allocation approach helps investors optimize risk and return throughout market cycles, ensuring the initial allocation is right and dynamically adjusting allocation as market conditions change. The BAF cushions volatility and allows participation in upside potential through a hybrid approach.

Franklin India Balanced Advantage Fund:

This fund has the flexibility to manage equity components dynamically, ranging from zero to 100% in equity and debt, respectively. It aims to maintain a gross equity exposure between 65% to 100%. If the equity allocation falls below 65%, equity derivatives are used to maintain the desired exposure.

Fund Performance:

The performance of the scheme will be benchmarked against the NIFTY 50 Hybrid Composite Debt 50:50 Index. The Equity part of the fund is managed by Rajasa Kakulavarapu and Varun Sharma. The Debt part is managed by Rahul Goswami, Anuj Tagra, and Chandni Gupta. The fund manager actively participates in-stock selection in Debt and Equity. The Fund has given a CAGR of 16% since its inception in 2023.

The key benefit of investing in FIBAF:

Investors with an investment horizon of 1 year or longer.

Investors seeking growth but are less comfortable with equity market volatility.

Investors seek better return potential than fixed income but with relatively higher risk tolerance.

Investors looking for better potential post-tax returns than conservative hybrid funds, despite accepting relatively higher risk.

Our thoughts:

FIBAF facilitates the timely achievement of investment goals and conserves portfolio value, especially in volatile markets. We think investing in these hybrid funds should do well over the next 1-2 years given the buoyancy in equity markets and expected rate cuts that could help the bonds.