In our fund pick, let us understand the potential benefits of investing with the Franklin India Technology Fund and Explore the dynamic world of technology progress that is happening in India, where innovation meets opportunity.

Why is it the right time to invest in the technology sector?

- Many Indian businesses are adopting new technologies like Digital, Cloud, and Gen AI, and increased consumer tech adoption is also driving growth.

- Reasonable valuations: The current divergence in sector valuations aligns with the broader market.

Key drivers of this sector: A road ahead

- Urbanization, rising disposable income, and demographic factors drive increased consumption in India. India is expected to add 300 million new urban residents by 2050.

- A significant portion of the population, about 42%, falls between the ages of 15 and 40, where tech consumption is much higher.

- Integration of e-services, e-tailing, and digital classifieds enables cross-selling opportunities.

- It is estimated that there will be around 900 million internet users in India by 2025, mainly due to affordable 4G and 3G data plans that have made smartphones the primary choice for internet access.

Why Franklin India Technology Fund?

- The Fund’s investments span a diverse range of industries, in Indian as well as global markets., including computers, hardware, telecommunications, electronics, media, information services, and precision instruments.

- These industries are anticipated to derive benefits from the continuous development, progression, and utilization of technology and communication services and equipment. The Fund will follow a bottom-up approach to stock pricing with a blend of Growth & Value investment strategy.

- The fund also invests about 7% of its total assets into the Franklin US Tech Fund which captures the top tech companies like Nvidia, Apple, Microsoft, and Amazon.

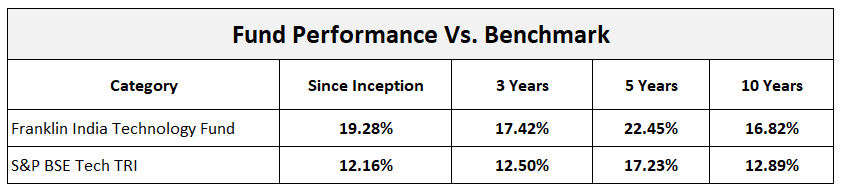

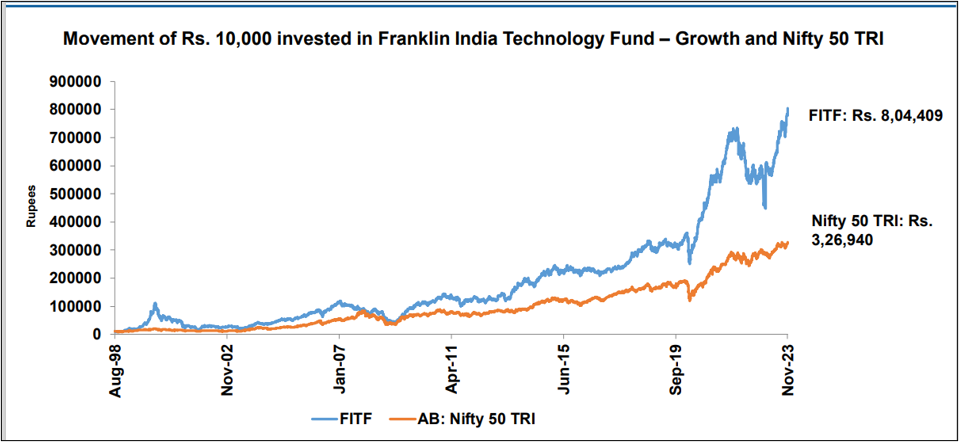

Fund Performance:

Who Should Invest?

The fund predominantly focuses on technology-related companies, catering to investors with a keen interest in this sector and a higher risk tolerance level. It is best suited for individuals with a long-term investment horizon of over 5 years to capture the technological progress in a growing economy like India.

Our thoughts:

Changing Technologies with Changing Times. Tech is omnipresent across all industries and is seen how it has enabled right from a streetside vendor to large companies to scale up their business. The digital penetration will surely increase. Indians are spending more than 5 hours daily on their smartphones. Smartphones, digital businesses, payment ecosystems, and high-speed mobile internet will be much bigger going forward. The current decade will provide more investing opportunities in the tech space in India. Investing in a technology fund offers an avenue to tap into the innovation and growth potential of the tech sector. With a Franklin India technology fund, investors gain exposure to global opportunities, diversification benefits, and resilience against economic shifts.

If you would like to Invest in the potential of tomorrow’s leaders today and watch your vision unfold with the growth of the future, contact us at 9845093554 and ask for Ravi.