Generally, the word retirement was associated with a person of life in the distant future. However, as we noticed during our conversations with many clients over the last few years that as they enter their 40s., they start thinking more and more about retirement savings.

‘Comfortable retirement’ is what is on their mind, and it depends from individual to individual based on their lifestyle. We help families to work on How much funds are required for retirement.

To guess a number for retirement, a typical family in the ’40s needs a comfortable retirement corpus of Rs. 5-6 crores minimum as a rule of thumb.

We all know that equity funds over a long period give the ability to beat inflation. So if you have time and can tolerate some risk, your portfolio of funds can have a retirement fund.

On this note, we have picked HDFC Retirement Savings Fund, managed by an experienced fund manager who keeps the retirement goal of the investor.

Our research team did a deep dive into the fund’s features and highlighted why you should consider this fund for investing.

Here we give you a solution-oriented fund that will make your retirement planning an easy and rewarding exercise with almost no intrusion into your current lifestyles

Fund Performance:

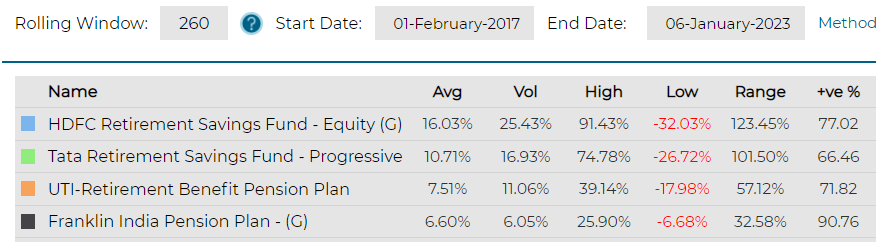

The average return of HDFC Retirement Savings Fund – Equity for the last 5 years is 16.04%. Since its launch (Feb 2016), it has delivered 18.17% average annual returns. The fund has the Highest range of 123.45%, making it suitable for both SIP and Lumpsum investment approaches. Comparatively, the fund has higher volatility, attracting aggressive investors for a long-term investment.

Fund Details:

Fund Manager: Mr. Shobit Mehrotra and Mrs. Shrinivasan Ramamurthy

Benchmark: Nifty 500 TRI

Category: Solution Oriented

Why this fund?

- This Fund has a lock-in period of 5 years presenting the magic of compounding and investment discipline among the investors.

- The fund will follow a multi-cap investment strategy focused on long-term investing.

- The Central Government has specified HDFC Retirement Savings Fund as a Notified Pension Fund. So the investments in the scheme qualify for benefits U/s 80 C of the Income-tax, 1961.

Who should invest?

So this Fund is well-suited for aggressive investors looking to create wealth in the long term.

It’s a good investment strategy for people aged 55 and above, too, as the Fund has a lock-in for 60 years or five years, whichever is closer. You can claim the advantage of tax saving.

It is also a good parking tool for Senior Citizens to get good returns of balanced funds with low risk. Senior citizens can invest in this Fund without locking and still claim tax benefits under section 80C.

To know more and invest in this Fund, please contact us at 9845093554 and ask for Ravi.