Today, in fund focus, let us discuss asset allocation funds, also called all-weather funds, that seek to manage portfolios through the combination of asset classes.

What is a multi-asset fund?

A multi-asset strategy, as the name implies, combines various asset classes to provide a broadly diversified portfolio. These asset classes often include stocks, bonds, commodities, and gold, and most recently, fund houses have started including real estate and international equities in the portfolio mix.

Why this fund allocation?

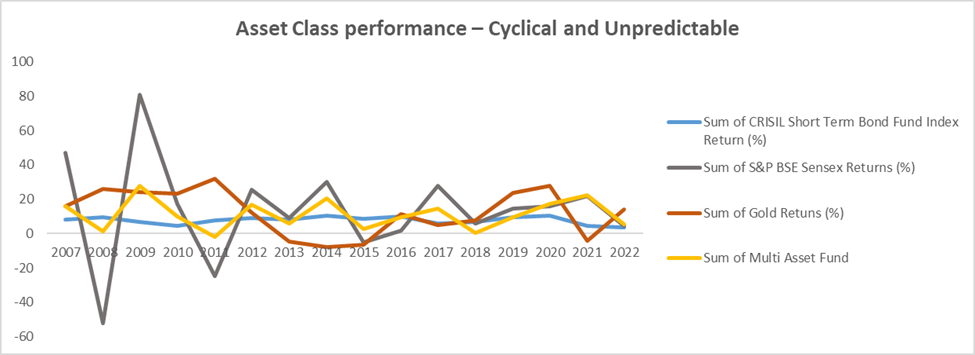

In the past two decades, during the COVID-induced slump and the post-correction rebound, there have been weak or negative correlations between Indian stocks and Indian bonds. Equities and gold move in opposing directions in a similar fashion. Gold typically performs well when the economic outlook is all gloom and doom, whereas equities need economic growth and expansion to flourish.

The above line chart clearly represents the correlation between equity, debt, gold, and the multi-asset category. You can observe that the multi-asset funds have given a balanced return even during the volatile market.

The multi-asset simulation does a fairly good job in terms of the return over the long run when compared to the four assets in isolation, and it does that with a rather low level of volatility.

How does a multi-asset fund help?

- India’s structural story remains intact and over the long-term equity will definitely help in the wealth-creation journey

- Variations in Interest rates make debt investments attractive.

- Gold will act as a hedge against high inflation and concerns about the global slowdown

Thus, multi-asset funds manage risk through asset diversification while also generating a stable and long-term return by responding tactically to market changes.

This is to ensure that your investments are not at the mercy of a single asset class, and if one asset is struggling, the other parts of the portfolio can compensate for you.

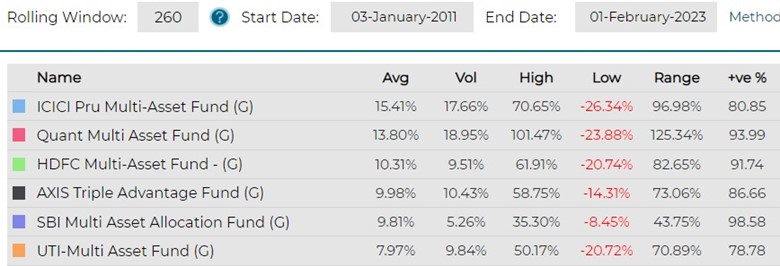

Fund Performance:

The average return of the ICICI Multi-asset Fund for the last 10 years is 15.41%. Since its launch in October 2002, it has delivered a 20.96% CAGR. The fund has a sound range of 96.86%, making it suitable for both SIP and lump sum investment approaches.

Fund managers: Mr. Sankaran Naren, Gaurav Chikane, and Sri Sharma The fund manager appears to follow a fairly long-term strategy in the equity portfolio, with 21 out of 60 stocks being in the portfolio consecutively for 4 years or more.

Benchmark: Nifty 200 Index (65%) + Nifty Composite Debt Index (25%) + LBMA AM Fixing Prices (10%)

Who should Invest?

This fund is appropriate for investors who wish for stability in the returns on their investments but have a low-risk appetite. This can be explored if you are very new to investing and have not built an acumen for diversifying with different assets.

It’s good to have this fund in each portfolio to take advantage of the multi-assets and to have a structured portfolio—a portfolio that does well irrespective of whether it is raining or shining. If you feel this fund should be a part of your portfolio, do contact us at 9845093554 and ask for Ravi