Have you ever thought of a bakery Or a Chai shop becoming a multimillion company?

Yes, why not?

We live in a country that has emerged as the world’s third-largest startup ecosystem. Currently, entrepreneurship in small businesses is much more than what it was two decades ago. Because it is easy to grow faster in childhood than in adulthood. The surrounding environment nurtures and makes it strong to face challenges. In the same way, environmental and govt policies support many small businesses.

Welcome to the Universe of Small cap Funds. These funds invest in stocks of relatively small companies. The growth rate of small businesses is higher than mid or large companies.

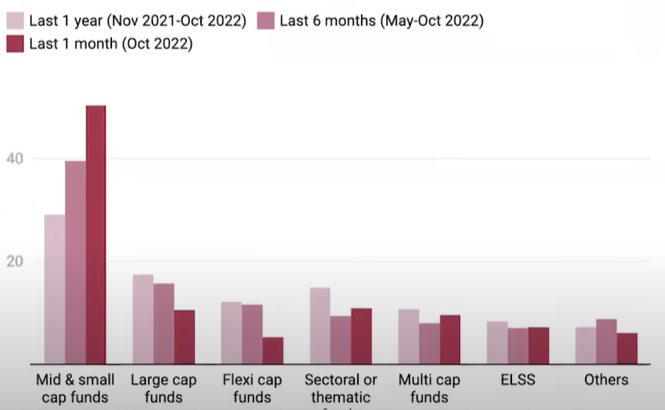

With every growth, there is associated risk. Of course, this category is riskier, but the thumb rule always wins. As an investor, we need to think long-term by taking short-term actions. With a growing risk appetite, small-cap funds are becoming investors’ favorites. The bar chart below shows the flow of funds over the last two years into the small-cap category.

Why SBI SmallCap Fund?

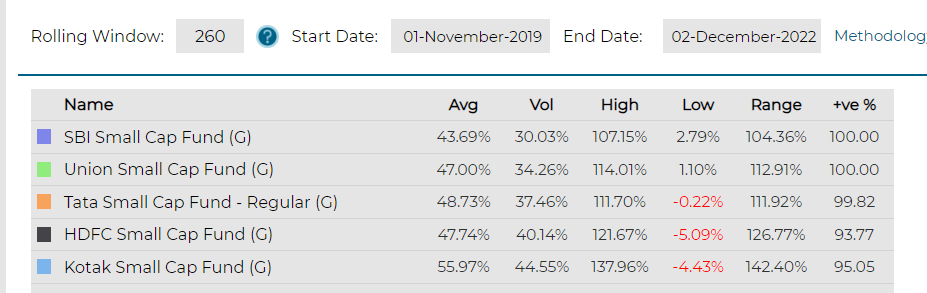

In the small-cap category, the SBI Small Cap Fund is the second-largest.

Rolling returns (43.69%) are more significant than average, and the S&P BSE Small Index -TRI demonstrates that the fund can deliver steady returns while limiting losses in a downmarket(2.79%). The fund has consistently performed better than average.

It is one of the top categories of equity mutual funds, with the highest average return of 18.97% since inception (2009).

Unlike large and mid-cap funds, which have to invest in the top 250 & 100 companies, the SmallCap categories have a much larger universe of companies that fund managers can identify, monitor, and invest in.

As a result, a skilled fund manager can recognize the patterns and take advantage of them for their investors.

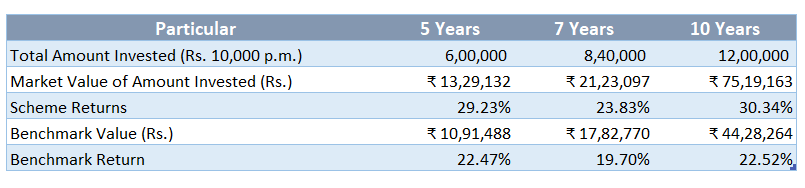

SIP Analysis:

The table above shows SIP returns over a period of time. (given is the total per annum amount for a specified period of time).

The fund managers, Mr. R. Srinivasan and Mr. Mohit Jain have a proven track record in identifying high-performance stocks, even during challenging times. Their bottom-up approach to identifying good businesses has created significant wealth for clients in the small-cap category.

Who should invest:

This fund is well-suited for investors looking to finance long-term objectives, such as retirement or a child’s education, and have at least a 7- year investment horizon.

How to invest?

One can invest in the SBI Small Cap Fund only via SIPs. The maximum investment amount is ₹ 25,000 per month per investor.

What next?

If you would like to invest in this fund, please contact us at 9845093554 and ask for Ravi.