They say, “The key to successful investing lies in recognizing the potential of the future before it becomes the present.” Today, in our Fund Pick, let’s delve into how investing in the seeds of future greatness today can yield the fruits of success tomorrow.

What are small-cap funds?

A small-cap fund primarily invests in companies with a market capitalization of less than Rs 5,000 crore. Small-cap companies tend to be more agile and adaptable, enabling quick responses to market changes and efficient implementation of growth strategies. This flexibility can result in higher growth rates and better adaptation to market dynamics.

Why invest in small-cap funds?

- Investing in small-cap funds involves the potential to identify early growth opportunities within future mid-cap or large-cap companies.

- Small-cap companies in India often operate in niche markets or emerging industries, presenting substantial growth prospects.

- Small-cap funds often identify household consumer products and their market segments that are not typically covered by large-cap funds.

Why invest now?

- Small caps offer a wide selection, including companies from 251st to 500th in market capitalization, along with over 500 others to choose from.

- India’s supportive ecosystem has driven the growth of the organized sector through measures like the Production Linked Incentive Scheme and increased infrastructure spending.

- Implementation of GST and initiatives like Make in India have fostered the transition to organized setups, while tariff hikes and strategic investments have expanded opportunities for small-cap companies amidst evolving business models.

- Global broad-based economic recovery. Indian corporates gaining from localisation in manufacturing

Why Bandhan Emerging Business Fund?

- The fund’s portfolio is strategically constructed with a focus on a combination of growth, economic revival, and thematic plays, employing a meticulous bottom-up approach.

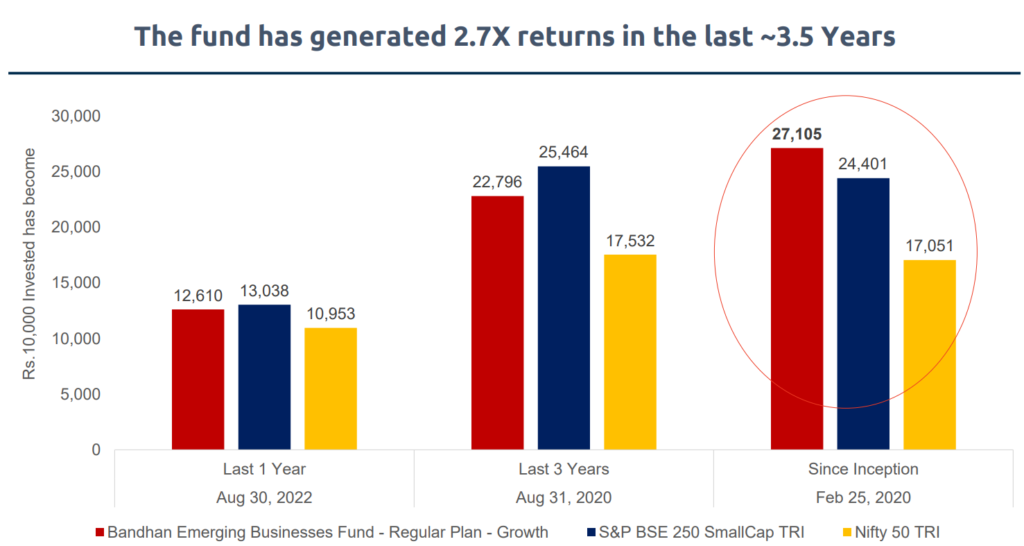

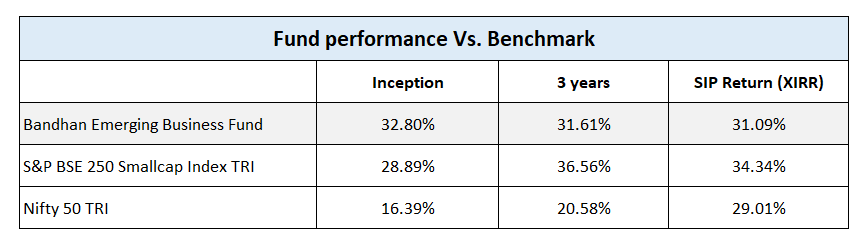

- The scheme is managed by Mr. Manish Gunwani (w.e.f. 28 January 2023) & Mr. Kirthi Jain (w.e.f. 05 June 2023) and Ms. Nishita Shah. The performance of the scheme will be benchmarked against the S&P BSE 250 SmallCap TRI. The fund manager actively participates in stock selection across various service sectors that generate good cash flows for the companies and capture the growth in the stock prices. Professional management has consistently delivered alpha in this category across periods.

We observed that from April 2023 onwards, there is an active alpha generation by the fund manager when compared to the benchmark as well as the category index.

Who Should Invest?

- Suitable for high-risk, long-term investors; not recommended for first-time or conservative investors.

- Suitable for those interested in participating in the basket of companies that will become future large-cap companies.

Our thoughts

Change in Fund manager – Manish Gunwani is known for his stock-picking ability. He previously delivered good returns on the schemes he managed both at ICICI and Nippon. We like his unique framework for his stock selection, known as Fund casing.

We also observe that the overlap is less when compared to other prominent small-cap funds such as SBI Small Cap, HDFC Small Cap, and HSBC Small Cap. Adding this fund to your existing portfolio would still make sense to participate in the growth potential of the larger universe of small-cap companies.

If you would like to Invest in the potential of tomorrow’s leaders today and watch your vision unfold with the growth of the future, contact us at 9845093554 and ask for Ravi.