The price is what you pay. Value is what you get. This famous quote by Ben Graham reminds the fund manager of the HSBC Value Fund throughout the time he picks stocks and holds them.

The HSBC Value Fund is true to its label, following a disciplined value-style approach. We are considering how this fund is currently positioned and why it is a good investment.

Before that, let us understand what the Value Fund is all about–

Growth and value represent the two dominant styles of investing. Growth investing is a fast and furious approach. However, when we look at value investing, we take a much slower yet steadier approach that seeks to buy companies trading at a lower price than their actual worth.

The idea is to invest in undervalued stocks based on fundamental analysis. The belief is that once the market realizes the actual value of such stocks, their price will increase, creating wealth for the investors.

The fund continues to leverage the difference between price and value. It means that it finds fundamentally sound companies and waits until their stock price falls below their intrinsic value. Buy them and sell them at a higher price over time.

This process creates wealth. HSBC Value Fund has exactly done this.

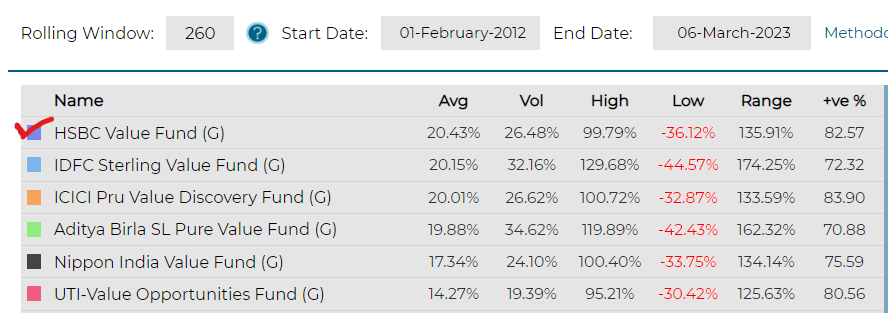

Fund performance:

The fund’s performance over the last 10 years is 20.43%. The fund is managed by an experienced and stable fund manager – Mr. Venugopal Manghat, Mr. Karan Desai, and Mr. Vihang Naik. Its performance has been outstanding (14.79%) since its inception (Jan. 2008).

Why this fund?

- The fund always stayed away from highly valued stocks. The fund was initially named the Fidelity Value Fund in 2012.

- The fund grew to over 8,000 crores in 2022 under the name L&T India Value Fund. Today, it’s called the HSBC Value Fund. (After L&T MF take over by HSBC)

- The fund’s current positioning shows that 54% is invested in large caps. The balance is invested in Mid and Small Cap stocks.

- If one were to look at the history of this fund, the bottom-up stock approach in the mid and small-cap portion has contributed significant alpha to this fund.

- The fund is now scouting for opportunities in growth stocks whose prices have fallen over the last year, thereby spotting “value’.

Who should invest in this fund?

These funds are appropriate for investors looking to diversify their portfolios for long-term investments, ideally longer than five years.

We recommend this fund as a part of your core portfolio for long-term wealth creation. If you feel this fund should be a part of your portfolio, contact us at 9845093554 and ask for Ravi.