Do you agree that investing in a mutual fund is more interesting if you invest in a stable return pattern that promises to add growth momentum? Here we come up with that one category to make your beliefs stronger.

Large and Mid Cap Fund:

Investing in mutual funds can be like choosing a family member to rely on. Like a father figure with years of experience, significant capital funds invest in established companies with a reliable track record, offering stability and security. Meanwhile, mid-cap funds are like a teenage son, growing and showing potential with smaller, emerging companies. Combining these two approaches can offer stable returns with room for growth. The fund we are discussing allocates 35% of its assets to large and midcap companies, leaving 30% at the fund manager’s discretion.

So if you are looking for a stable return with potential room for growth, large and midcap funds are for you.

Why this fund?

- The fund managers, Mr. Saurabh Pant and Mr. Mohit Jain, have a proven track record in identifying high-performance stocks even during challenging times. Their bottom-up approach to identifying good businesses has created significant wealth for clients in the large and midcap categories.

- By adopting a combination of growth and value-based investment styles, this fund aims to capture both potential for capital appreciation and income generation, which can help diversify its portfolio and reduce concentration risk.

- The fund’s current position shows that 41.5% is invested in large caps, 36.6% in mid-caps, 15.0% in small caps, and the balance in others.

Fund performance:

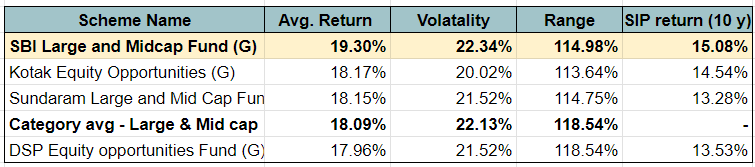

The fund’s performance over the last 10 years is 19.30% (rolling return), and its performance has been outstanding (16.05%) since its inception (Jan. 2013). The fund has consistently outperformed the benchmark. As you can see, the fund has a range of 114.98%, which indicates that it is suitable for SIPs and lump-sum investments. This fund enables you to enjoy the power of compounding with 15.08% SIP returns for 10 years. Therefore, you can invest a minimum of Rs 500 to start a SIP to achieve long-term goals.

Who should invest in this fund?

- The fund category is suitable for all investors as it offers the stability of large caps and the higher return potential of midcaps.

- And for those investors who look forward to long-term wealth creation and are comfortable accepting relatively high risk for not less than 5 years.

In conclusion, investing in a large and mid-cap fund like the SBI Large and Mid Cap Fund can expose investors to a diversified portfolio of high-quality companies with the potential for long-term growth, lower volatility, and professional management. To learn more about this category and add it to your portfolio, please contact us at 9845093554 and ask for Ravi.