Think of your investment portfolio as a team of champions! Short-term investments can only contribute for a limited time. Medium-duration funds can stay with you for 3 years and adapt to any challenges, including fluctuations in interest rates. So, if you want to build a champion team to overcome any challenge, a Medium duration fund best suits your investment portfolio!

What is a medium-duration mutual fund?

These are the debt funds that lend money to reputed, good-quality companies for a period of 3 years or more. The medium-term bond fund invests partly in government securities and partly in AAA-rated corporate bonds. This combination gives stability and a better yield compared to the interest rates offered by banks currently.

Why the HSBC Medium Duration Fund?

- The fund managers, Mr. Shriram Ramanathan and Mr. Kapil Punjabi have maintained the quality of the portfolio through a meticulous credit selection process that has resulted in a stable/upward trend with zero downgrades to keep it straightforward.

- Creating alpha by finding good investment opportunities based on yields, holding periods, and credit risk

- Aims to yield pick by selectively lending to high-quality borrowers while ensuring sufficient liquidity in the portfolio. The fund is classified as class (B-III) due to its relatively higher interest rate and moderate credit risk.

The fund’s current position shows that 48.68% is invested in Government securities, 37.20% in AAA equivalent, 7.49% in AA equivalent, and the rest in cash.

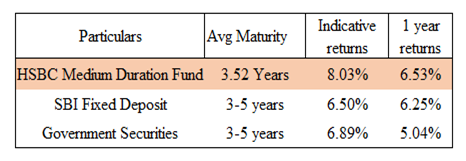

Though the fund is moderately riskier, the return on the fund is also more significant than the risk-free rate of return (6.5%), making it a better alternative than fixed deposits and GSEC. The fund’s average maturity is 3.5 years, less than fixed deposits and government securities, while the YTM of the fund is 8.03%, which is higher than FD and GSEC.

Who should invest in this fund?

- The strategy is to invest in fixed-income securities with a specific maturity to take advantage of expected changes in interest rates combined with “accrual products,” which generate income through interest payments.

- It is best suited for investors who wish to take moderate risk for 3 years or more.

When should you invest in this fund?

As the fund is sensitive to changes in interest. This is the best time to invest in the fund, as interest rates are expected to be stable or decrease slightly. The bond price is low but is expected to rise, resulting in capital gains for the investor.

In conclusion, investing in an HSBC Medium Duration Fund when interest rates are high will be a valuable addition to your portfolio because it adapts to different market conditions and provides stable returns for 3 years. To build a winning team of champions to help you reach your financial goals, please contact us at 9845093554 and ask for Ravi.