Indian equity markets have been on a remarkable ascent, reaching an all-time high of 19,000, despite facing headwinds such as US rate hikes and global inflationary pressures. There is a broader market participation with Industrials (manufacturing and infrastructure sectors) doing significantly better than other sectors.

What next? We think the consumption story is also beginning to show up.

Recent research reveals an intriguing trend: as our disposable income grows, so does our propensity to spend. In fact, the middle class has experienced a staggering rise in annual household income, doubling from 5-30 lakhs and jumping from 14% to 31% in 2022. And the projected 63% increase by 2047. This substantial boost in income has sparked an evolution in our spending patterns and overall standard of living.

Now, we yearn for luxuries, premium vehicles, dazzling jewelry, cutting-edge appliances, and immersive travel experiences. Healthcare has also become a priority. As we balance spending and saving, a captivating interdependent chain of growth comes to life, shaping a prosperous future for India.

Are you eager to learn about the fund pick for this month?

Well, it’s a thematic fund focused on consumption. Unlike a fast-moving consumer goods (FMCG) fund that targets specific product segments, a consumer fund takes a broader approach, investing in companies across various consumer-related industries such as retail, e-commerce, and consumer electronics. Both funds aim to capitalize on household spending patterns, but while an FMCG fund hones in on a specific product segment, a consumer fund covers a wider range of goods and services.

Which is the best fund to invest in, and why?

Mirae Asset Great Consumer Fund, taps into middle-class spending, investing wisely in dynamic stocks despite market uncertainties. India is experiencing similar trends in the consumer market to what happened in other countries like China in the early 2000s. Take, for example, the Mirae Asset China Consumer Fund. The Experienced fund managers recognized the vast potential in China’s consumer market, targeting thriving industries like retail, e-commerce, technology, and consumer goods. As China’s consumer market flourished, the fund experienced steady growth, delivering impressive returns.

Now, India stands poised for a similar journey, with a burgeoning economy and a promising consumption sector set to thrive in the next 5 to 10 years.

Why Mirae Asset Great Consumer Fund?

- Led by experienced managers, Mr. Ankit Jain and Mr. Siddhant Chhabria, this fund excels at selecting winning stocks. Their strategy prioritizes quality businesses with strong growth potential, high ROCE, and efficient capital utilization.

- The fund follows a robust bottom-up approach, focusing on growth companies with solid ROE, sustainable competitive advantages, and other qualitative factors.

- With a diverse portfolio spanning industries like auto, consumer discretionary, FMCG, insurance, and new-age tech-oriented businesses, the fund capitalizes on the rising domestic consumption-driven demand.

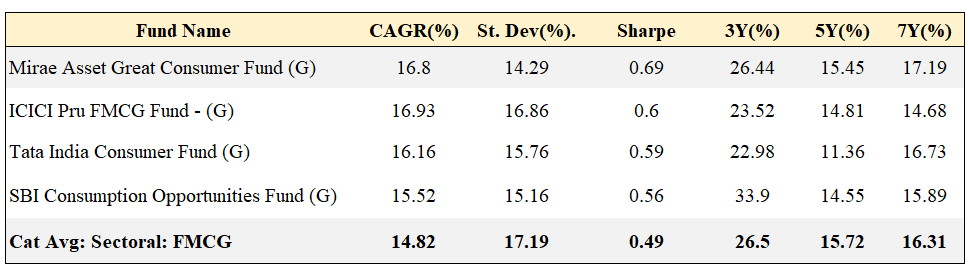

Fund Performance.

The fund has consistently outperformed its benchmark and peers, delivering high returns with a CAGR of 16.66%. It also boasts a higher risk-adjusted return ratio of 0.69, indicating significantly greater returns compared to its risk. Investors can begin investing in this fund through Lump sums or SIPs, with a minimum SIP amount of Rs 1000.

Who should invest in this fund?

This thematic fund comes with high risks, but higher risk often accompanies the potential for higher returns. Investors with a time horizon of at least 5 years can explore this fund as an opportunity for substantial wealth creation. Having said this, the consumption sector has always been more defensive, and the fluctuations are much smaller in extreme periods.

Our thoughts

“The growth of a nation’s economy is often reflected in the growth of its consumers. As people thrive and their aspirations expand, their spending power becomes a catalyst for progress and prosperity.” With increasing GDP and incomes, the expanding middle class fuels a surge in consumer spending. This boost benefits local businesses, including retail chains, entertainment companies, and consumer goods manufacturers. Investors who recognize this trend and invest in a thematic consumer fund can potentially capitalize on the country’s economic growth and the success of companies meeting the growing consumer demand.

To know more and invest in this Fund, please contact us at 9845093554 and ask for Ravi.