Today in Fund Pic, let’s talk about a fund where possibilities are endless and market fluctuations become opportunities. This fund seamlessly moves across several market sectors, responding to shifting conditions and looking for undervalued gems. The fund follows a value style in picking the stocks for its portfolio. Here’s a buzzworthy fund that has everyone talking! Let’s just dive into its intriguing details and find out why it is the talk of the town.

Flexi Cap category:

As the name suggests, the flexibility allows the fund managers to make changes in the portfolio as market conditions change, which ensures that the fund is delivering promising returns. This fund invests in companies of All sizes and across All sectors.

Why Parag Parikh Flexi Cap Fund?

- The skilled team of fund managers Mr. Rajiv Thakkar, Mr. Rukun Tarachandani, Mr. Raunak Onkar, and Mr. Raj Mehta responsibly manage domestic Equity, foreign investments, and the Debt component respectively. The impressive philosophy revolves around identifying undervalued securities, aiming to create substantial value for investors.

- The bottom-up approach of the fund focuses on achieving long-term capital growth through meticulous analysis of financial statements, coupled with a unique focus on understanding human emotions.

- The investment in foreign stocks remains attractive and profitable as the fund minimizes currency risk by hedging currency exposures using “futures contracts”. This approach protects investors from potential losses due to exchange rate fluctuations.

- The fund’s current position shows that 68.09% is invested in domestic equity, 17.15% in foreign equity, 14.27% in cash, and the rest in debt.

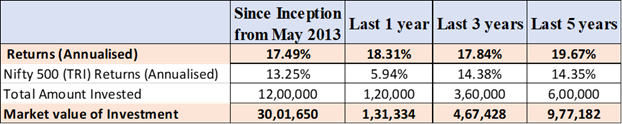

SIP Investment Performance (Assumption: Rs 10,000/- is invested on the first of every month.

Based on the above chart, it is evident that the fund has consistently outperformed the benchmark across all time horizons, showcasing its strong track record. The longest time horizon proves particularly beneficial for maximizing returns due to the power of compounding. The fund is suitable for both lump sum and Systematic investment planning(SIP). Investors can start their SIPs with as little as Rs 1000.

Who should invest in this fund?

- Investors Seeking Diversification: This fund transcends geographical boundaries and invests in both Indian and international equities, allowing investors to benefit from a broader spectrum of opportunities.

- Investors with a Long-Term Investment Horizon: Investors who look forward to capital appreciation must stay invested for a minimum of 5 years.

In conclusion, investing in Parag Parikh FlexiCap Fund empowers investors to leverage the expertise of fund managers and capture potential returns across different market capitalizations. This unique approach offers the opportunity for significant long-term growth, making it the best choice for building a well-rounded investment portfolio. To learn more about this category and add it to your portfolio, please get in touch with us at 9845093554 and ask for Ravi.