In today’s changing economy, India’s services sector is booming with growth and innovation. With the world moving toward digital and service-based economies, India is leading the way, making it an exciting opportunity for you to participate in the growth of the country.

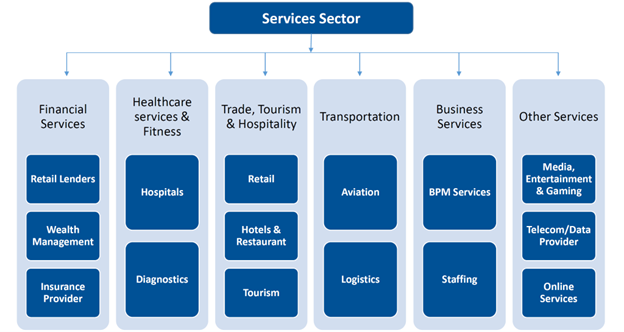

Let’s see what the Services Sector includes.

The services sector includes Healthcare, Fitness, Tourism and hospitality, Transportation and logistics, Education, Staffing, Wealth Management, Media, Retail, Aviation, Legal, Architecture, Design services etc.

How big is the Services sector market?

The services sector is the key driver of India’s economic growth. The sector has contributed to nearly 54% of the GDP. The service sector has emerged as the highest employment generator with a 5-7% y-o-y growth. Services exports are projected to set a new record with a compound annual growth rate of 26.79% during 2022-23

Why India is and will be the most attractive Services sector story in the world

The growth of India’s services sector is shaped by a combination of domestic and global influences. Recent years have witnessed robust double-digit growth across various service industries, driven by digital technologies and a supportive governmental framework.

In FY23, India’s services exports rose by 42% to US$ 322.72 billion from US$ 254 billion in FY22 and are expected to reach US$ 400 billion in FY24. India‘s IT and business services market is projected to reach US$ 19.93 billion by 2025.

With ongoing reforms in areas such as trade barriers, foreign direct investment (FDI) regulations, and deregulation, the services sector in India is poised for sustained and healthy growth in the foreseeable future.

Why Sundaram Services Fund?

- The Sundaram Services Fund focuses on services sub-segments with long-term growth potential and looks for leaders within those segments.

- Sundaram Services Fund is an opportunity to invest in a sector representing 66% of the Indian economy that also happens to be among the world’s fastest-growing, at 9.2%, in 2023.

- This fund targets India’s untapped Consumer Finance sector, poised for growth due to new regulations, and seeks opportunities in Healthcare, Retail, Travel, Aviation, niche IT services, and Online services, aiming to maximize returns by identifying promising sectors

- The Fund will invest in a well-diversified portfolio of large-cap, mid-cap, and small-cap stocks – A Multi cap portfolio offering investment opportunities across the market cap curve. Hence, there exists a significant potential in emerging companies.

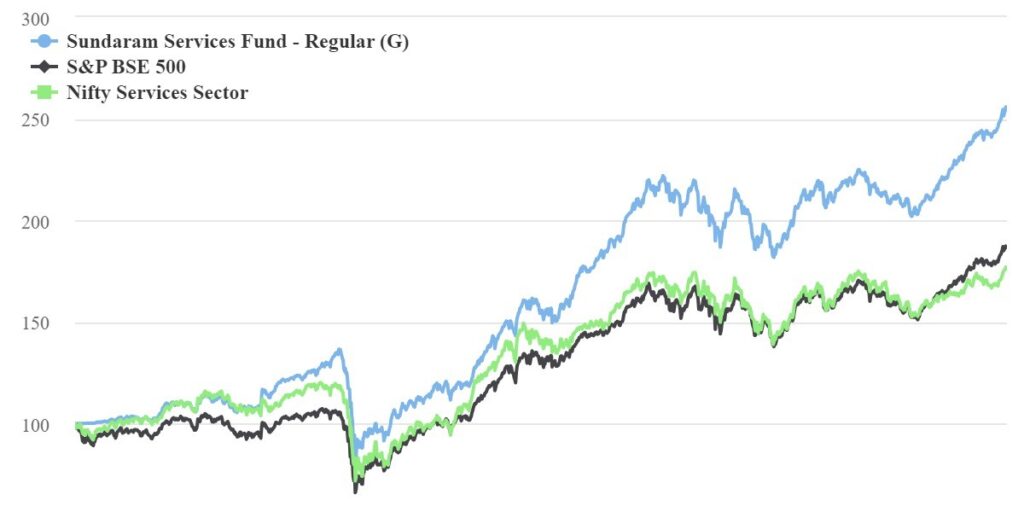

Fund Performance :

The above chart represents the performance of the fund from its inception (2018) till date.

The average number of days the fund has taken to recover during its fall in the temporary market fall is around 49 days.

The scheme is managed by Ravi Gopalakrishnan and Rohit Seksaria. The performance of the scheme will be benchmarked against the NIFTY Services Sector TRI. The fund manager actively participates in stock selection across various service sectors that generate good cash flows for the companies and capture the growth in the stock prices.

Who should invest?

The Sundaram Services Fund is a good choice for investors who are willing to take on high risks in exchange for the chance to earn high returns. It focuses on specific sectors to maximize potential gains.

Why we think this fund will do well.

Economic growth, rising per capita income, highly skilled manpower, rising government spending, and technological progress; all contributed to and have redefined the Services growth story.

As India’s economy undergoes a transformation, the services sector is a beacon of growth and innovation, driven by digitalization and government support. The Sundaram Services Fund, with a focus on high-growth segments, offers a unique opportunity to tap into this booming sector. As India’s services sector continues to thrive, this fund is your ticket to long-term financial success.

If you would like to participate in India’s Growth Story, contact us at 9845093554 and ask for Ravi.