‘Whatever is easy is difficult to do.’ Investing money regularly is one such ‘easy’ thing that’s difficult to do. But if done diligently, it makes creating wealth easy. And the case of Mr S, outlined below, is proof of that.

One day, our office had an unexpected visitor. Let’s call him Mr S. He told us he wanted to invest regularly and listed his reasons for doing so.

After understanding his motivations, values, and risk appetite, we guided him on the next set of steps he needed to carry out to achieve his goals.

We emphasised that the recommended way for a salaried person to accumulate wealth is through the path of automated and systematic investments in Mutual Funds.

Happily, for Mr S, he bought our advice and agreed to commit to systematic investing. Thus commenced his investment journey with us 7 years back.

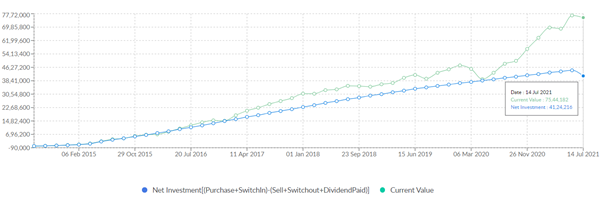

7 years later, today, the graph above reveals the results of his systematic investment plan – steady accumulation of a corpus represented by the blue line.

Before we conclude this true story, we invite you to take another look at Mr S’s 7-year investment journey. Please note: he invested every month. He was patient. He stayed invested. And for his dedication, he was rewarded with a healthy upward sloping green line and the sweet fruits of compounding annual returns of more than 16%.

The Bottom Line: Investing in Mutual Funds via Systematic Investment Plan (SIP) is the time-tested way to achieve life goals. And for a deeper dive into the nuts and bolts of SIP-thinking, we encourage you to read our blog on the Basics of SIP.